Federal Reserve officials restated their pledge to hold the benchmark interest rate near zero and will keep buying bonds, judging that the coronavirus pandemic "poses considerable risks to the economic outlook over the medium term."

The Federal Open Market Committee (FOMC) said in a unanimous statement Wednesday in Washington that it "will use its tools and act as appropriate to support the economy."

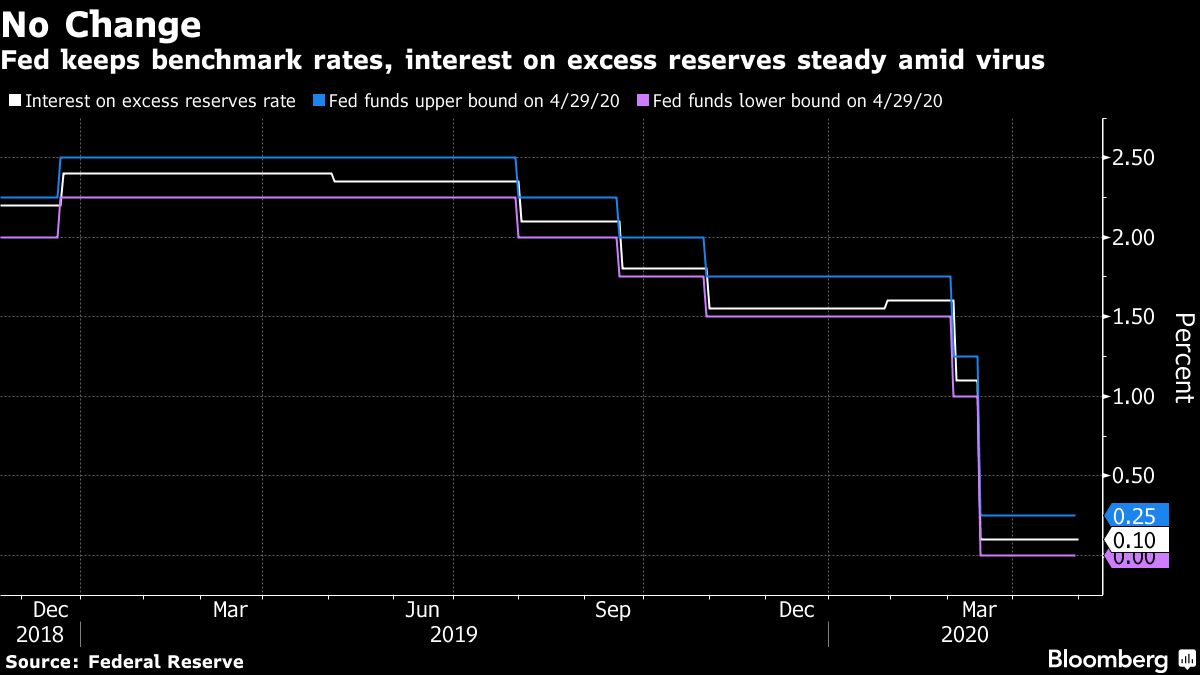

Officials Wednesday left unchanged their vague guidance on the future path of rates. The statement repeated language from March 15 saying the committee would keep the benchmark target range near zero "until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals."

U.S. stocks held gains after the Fed's statement, while yields on 10-year Treasury notes edged up slightly, to 0.62 percent.

Regarding asset purchases, the FOMC used wording similar to last month, saying the buying of Treasuries and mortgage-backed securities will continue "in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions."

Unprecedented Action

The central bank has mounted an unprecedented push to limit the economic harm of the coronavirus, which has plunged the global economy into recession and likely sent U.S. unemployment well above 10 percent after businesses shuttered to slow the contagion. Government data released earlier on Wednesday showed U.S. gross domestic product (GDP) shrank at an annualized 4.8 percent rate in the first quarter, the largest drop since 2008.

Policymakers last month slashed their benchmark rate and launched a massive bond-buying campaign to stabilize markets for Treasury and mortgage-backed securities that had become dangerously unsettled amid the pandemic. The federal funds rate has stood in a range of 0 to 0.25 percent since mid-March.

The central bank's Board of Governors has also responded to the crisis by announcing nine extraordinary lending programs, pledging to make funds available to banks, money market funds, companies, cities, and states in an unprecedented use of the Fed's emergency powers.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.