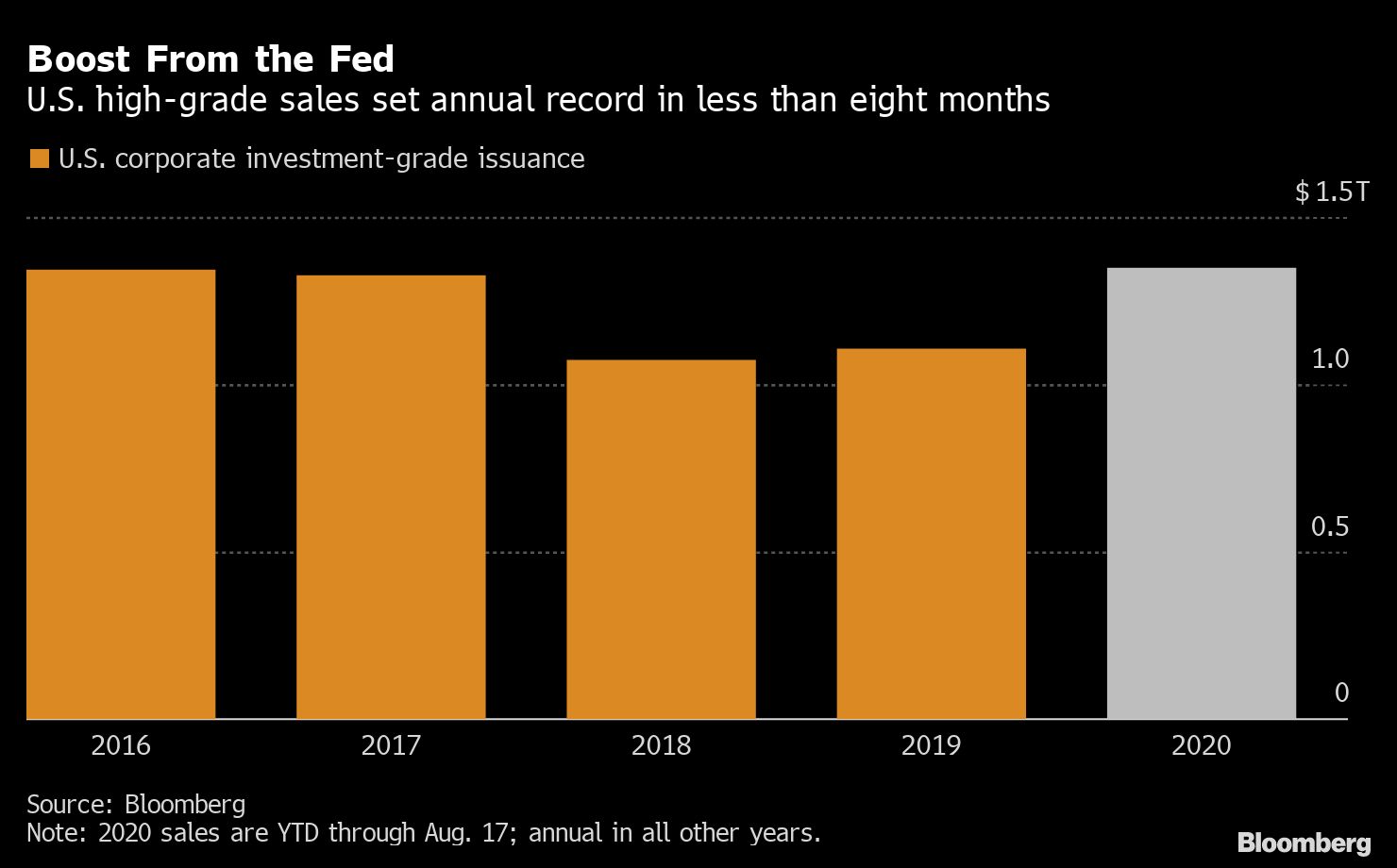

U.S. corporate investment-grade issuance reached a record $1.346 trillion Monday, surpassing 2017's full-year total in less than eight months amid seemingly endless investor appetite following the Federal Reserve's unprecedented steps to bolster liquidity.

The Fed's March pledge to use its near limitless balance sheet to buy corporate bonds has lifted nearly every corner of the market, allowing struggling cruise lines, plane makers, and hotels to tap much-needed financing while providing top-rated companies—from Alphabet Inc. to Visa Inc. and Chevron Corp.—access to some of the cheapest funding ever seen.

Just five months ago, this kind of issuance was virtually unimaginable. The market was frozen as the coronavirus ravaged the United States and brought the economy to a standstill. But following the central bank's intervention, demand quickly returned and hasn't waned since. The Bloomberg Barclays U.S. Aggregate Corporate index reached a record-low 1.82 percent in early August, down from more than 4.5 percent in March.

Recommended For You

"Corporate treasurers got the bejesus scared out of them when the funding markets completely shut down in the third and fourth weeks of March," Gregory Staples, head of fixed income at DWS Investment Management, said earlier Monday. "So there was the recognition that liquidity is very important and the markets may not be open forever."

A $6.5 billion debt offering from Intercontinental Exchange Inc. and 10 other deals helped secure the issuance record on Monday. The sale in five parts from the owner of the New York Stock Exchange will finance its acquisition of Ellie Mae Inc. Honeywell International Inc. and Duke Energy Corp. were also in the market.

As 2020 enters the home stretch, there's little sign the borrowing binge is slowing. Investors have poured over $100 billion into funds that buy high-grade bonds over the last 17 weeks, according to data from Refinitiv Lipper.

And the cheaper borrowing costs are enticing American companies to return to credit markets two, three, even four times. Many are refinancing debt due in the coming months and years, taking advantage of the opportunity to extend their maturities.

More than 30 borrowers priced deals last week, issuing almost $50 billion. DoubleLine Capital said it expects supply to reach $1.9 trillion before the year is out.

Still, the barrage of issuance is starting to take its toll on returns, with high-grade bonds in the midst of their worst month since March. They lost 1.58 percent last week and are down 1.2 percent so far this month, on track for the first decline since the pandemic took hold and up-ended markets earlier this year.

"With the debt that these companies have raised, you have to keep in mind that it does add cash to the balance sheet," Barry McAlinden, senior fixed-income strategist at UBS Global Wealth Management, said Monday. "They're still very prudent. The narrative isn't that they're being reckless at all in adding leverage to the balance sheet during uncertain times."

—With assistance from Brian Smith, Michael Gambale and James Crombie.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.