After tapping the bond market at a record-shattering pace in recent months, corporate America is more indebted today than ever before.

And while much of that fresh cash—more than US$1.6 trillion in total—helped scores of companies stay afloat during the pandemic lockdown, it now threatens to curb an economic recovery that was already showing signs of sputtering. Many companies will have to divert even more cash to repaying these obligations at the same time that their profits sink, leaving them with less to spend on expanding payrolls or upgrading facilities in months ahead.

The over-leveraging of America's corporate sector is not a brand-new development, of course. It's been building for more than a decade, ever since the last crisis—the housing-market meltdown—prompted the Federal Reserve to pump unprecedented amounts of cash into the economy, a policy tool that it has taken to new heights during the pandemic as it has supported corporate credit markets.

Recommended For You

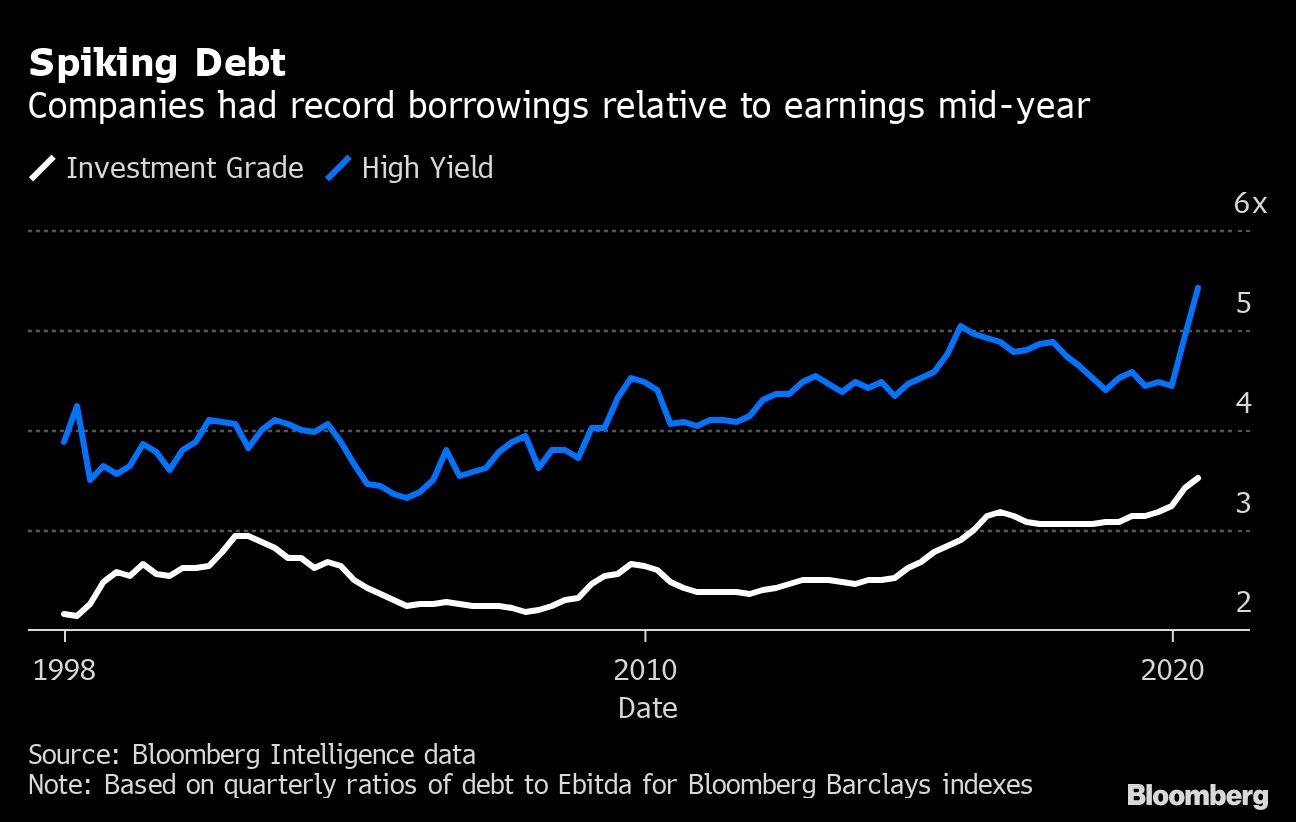

But in a sign of just how pronounced the borrowing overhang has become, the average junk-rated company had debt levels relative to earnings that were so high in the middle of the year, according to a new analysis by Bloomberg Intelligence, that they almost would have tripped do-not-touch alerts from banking regulators a few years ago. Those warnings back then only applied to a handful of borrowers. Had regulators not opted to drop these warnings, they could today apply to far more.

"An overburdened corporate sector is likely to grow less rapidly, and that could slow the whole recovery down," said Kathy Jones, chief fixed-income strategist for Charles Schwab Corp.

A slower recovery could have wide-reaching implications in financial markets. Many securities prices reflect investors' expectation that profits will normalize next year, when in fact it could take at least two or three years, said Lale Topcuoglu, senior fund manager and head of credit at J O Hambro Capital Management in New York. She sees many junk bonds as being overpriced.

"It just seems absolutely incredible how much people are closing their eyes and buying," Topcuoglu said.

Companies have seen their debt burdens grow in recent months as their earnings have plunged in the pandemic. That pain is expected to increase through the rest of 2020, as sales continue to deteriorate compared with the prior year, even if borrowing levels stay the same.

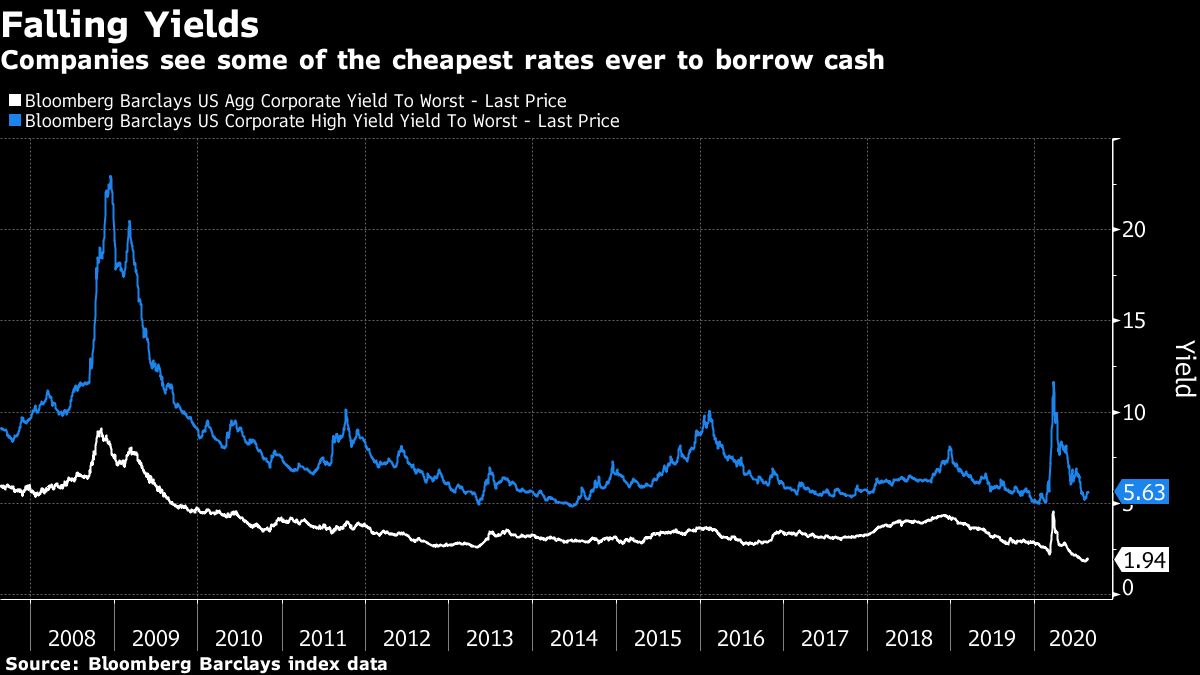

Corporations have also been borrowing heavily as the Fed has slashed short-term interest rates to near zero and supported credit markets through, for example, buying company bonds. Lower rates have spurred investors to buy higher-yielding, riskier securities, which has allowed even junk-rated firms to borrow more to tide them over during the crisis. High-grade issuers have already sold more bonds in 2020 than any other full year in history. Junk corporations have surpassed 2019's total already.

Much of the debt sold in recent months has refinanced maturing borrowings at lower rates, and some companies are holding onto the money they raised as cash and may end up not spending it. In general, the fact that companies managed to stay afloat during the pandemic is a good thing compared with the alternative of even more corporations having gone bankrupt. But not all companies can access credit. Smaller borrowers, for example, are often getting shut out.

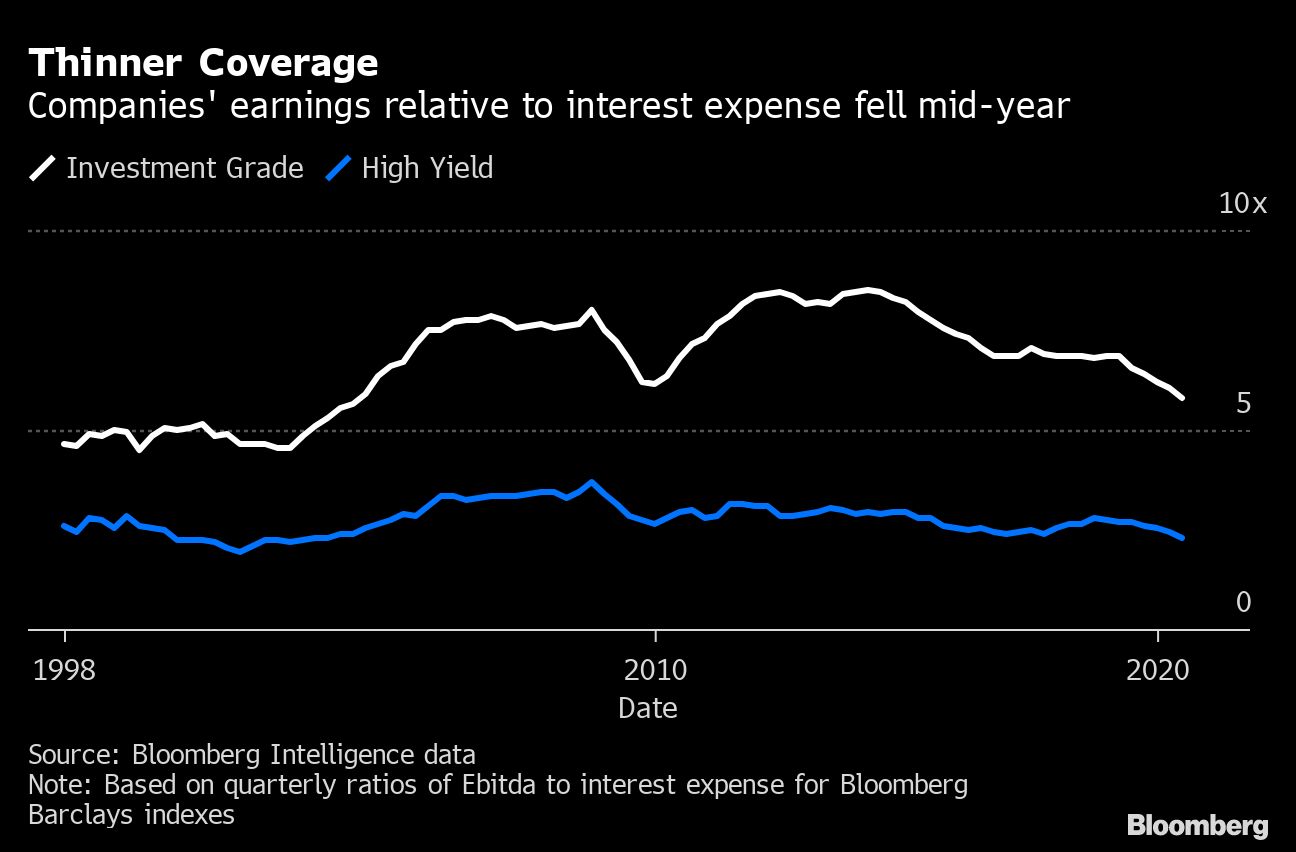

There will probably be a hangover. Many companies were groaning under their debt loads even before the Covid-19 pandemic, and now will have to work harder to cut borrowings as earnings remain depressed. Even if companies are hanging onto the money they borrowed, they must still pay interest on it, and could eventually use the cash if the pandemic drags on.

The ratio of total debt to EBITDA (earnings before interest, tax, depreciation, and amortization) for investment-grade companies was 3.53 in the second quarter, according to an analysis from Bloomberg Intelligence. That's the highest level for the Bloomberg Barclays U.S. Corporate high-grade index in data going back to 1998, and is up from 3.42 in the first three months of the year, when the impact of the pandemic was only just beginning to show up in earnings. It compares with a 20-year average of 2.65.

For high-yield debt, companies' leverage ratio stood at a record 5.42 at the end of June, up from 4.93 at the end of March and 4.44 at the end of 2019. Avis Budget Group Inc., the car rental company, had debt equal to 27 times earnings as of June 30, up from five times at the end of March, as it burned cash in the second quarter, although that figure could improve later this year when its earnings start to rebound. In 2016, banking regulators pushed back against leveraged buyouts (LBOs) that left companies with ratios above 6.

As corporations shunt more of their earnings toward paying interest and paying down debt, they will struggle to hire and invest as much as they would at the end of a more conventional recession, said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. That could translate to a relatively sluggish recovery instead of the fast, V-shaped recovery many investors hope for.

"The debt overhang is going to be a headwind for capital spending and for hiring, not just in the second half of the year but probably into next year as well," Feroli said.

Lower Yields

Anheuser-Busch InBev NV is rated investment-grade but had a net leverage ratio in the second quarter of nearly 5, a level more commonly associated with junk ratings, as demand for its beer fell in bars and restaurants. At the end of 2019, that ratio was a still-high 4, and the company had been trying to cut it to closer to 2. AB InBev's debt load swelled after its massive acquisition of rival SABMiller Plc in 2016.

With short-term interest rates having fallen to near-zero levels, borrowing is cheaper for most companies than it was just a year ago. Average yields on U.S. investment-grade corporate bonds touched all time lows of 1.82 percent earlier this month and are still hovering near those levels, according to Bloomberg Barclays index data.

But companies still have lower earnings relative to their required interest payments. The ratio of their EBITDA to their interest expense, known as their interest coverage, fell to 5.8 in the second quarter for investment-grade companies, compared with a 20-year average closer to 7. The June 2020 level was the lowest since 2003. For junk-rated companies, the interest coverage ratio fell to 2.3 in June, also the lowest since 2003.

Ratings firms are taking note of the broad downward trend in credit quality. S&P Global Ratings downgraded more U.S. high-yield debt in the second quarter, relative to upgrades, than at any other time in at least a decade, according to data compiled by Bloomberg.

Credit metrics have been eroding despite some evidence that the economy is stabilizing or even recovering. As of Thursday, more than 80 percent of the S&P 500 companies that posted second-quarter results performed better than analysts' average expectations, according to Bloomberg Intelligence data.

Even with that improvement, the economy is still weak. Corporate earnings per share (EPS) fell by about a third in the second quarter from the same period last year, and are likely to fall in the third and fourth quarters as well. Debt loads are also higher, and strategists expect leverage and interest coverage to erode further.

Some of the worst credit deterioration has happened for transportation companies, which have suffered as customers have stayed home. For junk-rated companies, leverage in the transportation sector jumped to a staggering 10.77 times for the second quarter, up from 5.24 times in the first quarter, driven largely by the airlines.

The consumer cyclical sector also saw a large increase in leverage ratios, from 5.29 to 7.51 in the first quarter, driven in part by cruise lines and the fall of Ford Motor Co. into junk.

Investors have given companies a break for about a year and are looking ahead into mid-2021 or later to evaluate where they will perform after, for example, the world finds and distributes a Covid-19 vaccine. That explains why cruise companies that are burning cash, such as Royal Caribbean Cruises Ltd. and Carnival Corp., have been able to borrow repeatedly, and have seen most of their new bonds trade well above the price at which they were originally sold.

But even if bond prices are broadly rising, investors need to be cognizant of the risks they're buying, said Schwab's Jones. "This cycle is very different because we've had so much support from central banks and we have so much liquidity in the market," Jones said. "But the old saying 'liquidity does not equate to solvency' is something people need to keep in mind when they're investing."

—With assistance from Noel Hebert, Joel Levington, Hoai Ngo, Molly Smith, Davide Scigliuzzo & James Crombie.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.