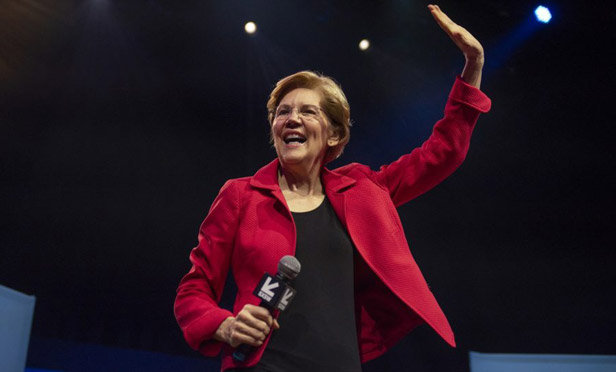

Sen. Elizabeth Warren at SXSW. (Photo: Callaghan O'Hare/Bloomberg)

Sen. Elizabeth Warren at SXSW. (Photo: Callaghan O'Hare/Bloomberg)

During her speech on August 19 at the Democratic National Convention, Sen. Elizabeth Warren, D-Mass., strayed from her usual "crackdown on Wall Street" message, focusing instead on child care and praising presidential candidate Joe Biden's plans to increase Social Security benefits, cancel millions in student loan debt, and "make bankruptcy laws work for families."

Now, buzz is swirling around what role, if any, she might play in a Biden administration. Given her acumen in financial regulations, might she be picked as Treasury secretary? How about director of the Consumer Financial Protection Bureau (CFPB), the controversial agency she helped create?

Recommended For You

According to Brian Knight, senior research fellow and director of innovation and governance at the Mercatus Center at George Mason University, if Biden wins, the Senate flips to Democratic control, and the House stays that way, Warren "may have a lot more power in dealing with financial issues by staying in the Senate." That said, among potential posts in the Biden administration, secretary of the Treasury "makes the most sense" for Warren.

While not a primary regulator, Treasury "does a lot of work" in terms of regulatory policy, along with "facilitating the administration's view and interacting with Congress," Knight notes. Treasury secretary would be the "capstone, most prestigious position" for Warren.

As to Biden's regulatory focus, "financial regulation will be one of the targeted sectors for a robust increase," says Aaron Cutler, a partner in the Government Relations and Public Affairs practice at the global law firm Hogan Lovells.

The CFPB under Biden would "become very active again," with "many new regulations and increased enforcement activity" likely on tap, Cutler says. There would also be "an uptick" in regulatory activity at the Securities and Exchange Commission (SEC).

Changes in tax policy, namely a financial transaction tax, "could be put on the table and implemented as a revenue raiser," Cutler says. Plus, the corporate tax rate would likely be raised, "especially if Democrats were to win the Senate" along with a Biden victory.

"As part of a tax increase, it is easy to see Democrats targeting individuals making over $500,000 year, which would particularly impact those in the financial services sector in New York."

Investigations by both regulators and lawmakers would also spike, Cutler adds, as Democrats pivoted their eyes from the Trump administration back to "their core policy issues"—like Wall Street and private equity.

From: ThinkAdvisor

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.