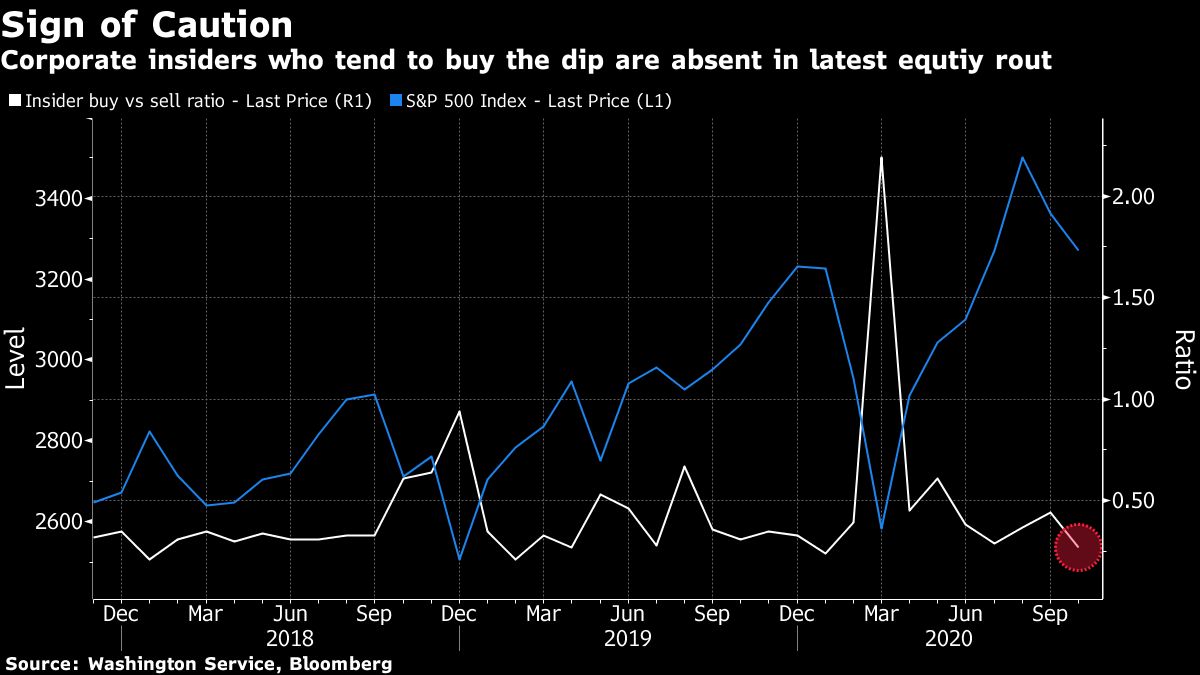

Large speculators and other heavyweight investors have been eager to buy the dip during the stock market's stormy October. One group that hasn't: executives in charge of U.S. companies.

Corporate insiders, whose buying correctly signaled the bottom in March, have refrained from bargain hunting this time. Fewer than 380 corporate executives and officers snapped up shares of their own firms last month, the second-lowest showing in at least two years, according to data compiled by the Washington Service. While sellers also retreated, they did so at a slower rate than buyers. As a result, insider purchases trailed sales by the most since January.

Recommended For You

This behavior is at odds with the behavior of commercial traders grouped under the Commodity Futures Trading Commission (CFTC) category "large speculators," who have boosted their net positions in S&P 500 e-mini futures to the highest level since January 2019.

Trepidation on the part of investors who may have the best knowledge of their own businesses is a troubling sign to Malcolm Polley, president and chief investment officer at Stewart Capital Advisors LLC. "What they're telling you is: Our stock is not cheap, and may be expensive, so it doesn't make sense for us to buy the dip," Polley said by phone. "While earnings have certainly improved versus Q2, the rate of improvement going into Q4 and Q1 of next year will probably slow pretty dramatically."

At roughly 21 times forecasted earnings, the S&P 500's valuation was about 2 points below the level seen in September, when the index hit an all-time high. Still, with company profits falling for a second quarter relative to a year ago, the multiple sat 18 percent above its average in the past five years.

Insiders bought $74.3 million worth of shares in October, down 43 percent from the previous month, according to Securities & Exchange Commission (SEC) filings for U.S.-listed corporations. Selling by the group dropped 29 percent, to $1.67 billion.

Stocks rose to start a new week full of macro events, with the S&P 500 rising 1.2 percent ahead of the U.S. presidential election on Tuesday and a Federal Reserve interest rate decision on Thursday. The benchmark dropped more than 7 percent from October 12 through Friday, as Covid-19 cases increased, policymakers failed to reach an agreement on government aid in Washington, and profit outlooks from tech mega-caps alarmed investors.

Mike Wilson, the chief U.S. equity strategist at Morgan Stanley, whose call for an October selloff proved prescient, says now's the time to add positions. As more and more companies return to profit growth, the tech-dominated market advance will broaden out, he said.

"The correction we expected is now mostly finished," Wilson wrote in a note Monday. "And adding to equities on further weakness this week is recommended."

As violent as the latest selloff looked, it did little to discourage equity bulls who have piled in to stocks in anticipation of continued fiscal and monetary support. A custom gauge of sentiment compiled by Citigroup Inc. showed that the market was still in "euphoria" territory, despite a retreat from the highest level since the dot-com era.

The stretched positioning continues to make the market vulnerable to shocks such as disappointing earnings, according to Tobias Levkovich, Citi's chief U.S. equity strategist. Tracking changes in analyst estimates, the firm found that the proportion of S&P 500 companies experiencing upgrades has stalled at above 70 percent, a sign that earnings revision momentum may be peaking.

"The crowded nature of concentrated ownership forces us to think about a kind of prisoners' dilemma game theory, whereby we have to worry about others' actions affecting our holdings," Levkovich wrote in a note. "Until a couple of months ago, we had to contend with their buying activity, and the trend may be changing."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.