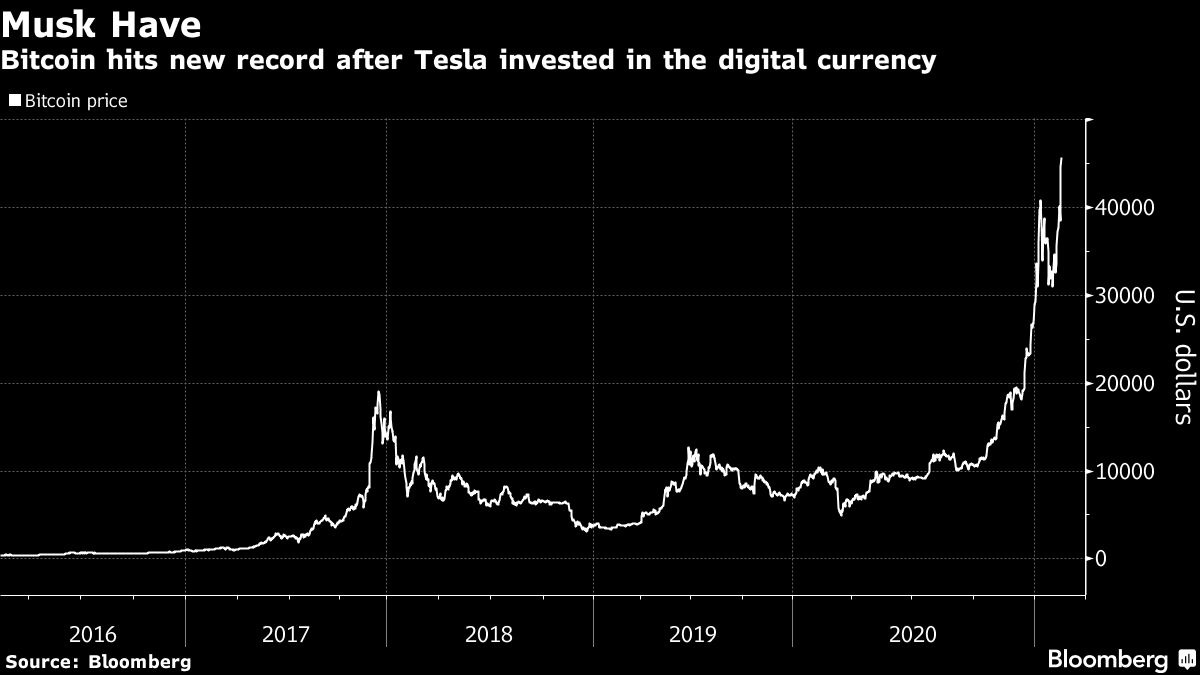

Bitcoin hit a fresh record above $47,000 on Tuesday after Tesla signaled its intent to begin accepting the cryptocurrency as a form of payment. Bitcoin quadrupled in value last year and is up another 60 percent so far this year, amid endorsements from high-profile investors like Paul Tudor Jones and companies like PayPal Holdings Inc.

Still, though Tesla's $1.5 billion investment makes up about 8 percent of the company's cash reserves, it's a drop in the ocean compared with the overall holdings of America's blue-chip corporates. The purchase is worth just 0.05 percent of the $2.79 trillion of cash and cash-equivalents held on the balance sheets of S&P 500 members, according to data compiled by Bloomberg.

Recommended For You

Crypto acolytes have been saying for some time that corporate adoption is imminent, but in reality it had been limited to firms such as MicroStrategy Inc. and Square Inc. The involvement of Tesla—the fourth biggest company in the S&P 500, which is helmed by the world's richest man—brings the discussion to the big leagues.

"We see fundamental reasons for corporate crypto treasury exposure and expect others to follow suit," wrote strategists at Fundstrat Global Advisors including David Grider on Monday, citing increased payment acceptance and the threat of disruption from blockchain. "We don't think this happens overnight, but we do think there's much more room for corporate treasury penetration and expect the trend to continue."

However, James Angel, an associate professor at Georgetown University believes the asset class is just too risky for the likes of treasurers. There is no compelling business case for Tesla, or any other corporation, to speculate in bitcoin, he said in emailed comments.

"Corporate cash managers are generally quite conservative and invest corporate cash balances in safe liquid assets," Angel said. "Bitcoin is highly volatile and can easily go up or down 10 percent in a day, or 50 percent in a year—certainly not a good short-term store of value."

And while Tesla announced plans to accept bitcoin for purchases, hardly anyone uses the cryptocurrency for anything beyond speculation. Data from New York-based blockchain researcher Chainalysis Inc. showed that only 1.3 percent of economic transactions came from merchants in the first four months of 2019.

See also:

Others disagree and insist there is growing interest from the corporate world. MicroStrategy's CEO Michael Saylor last week hosted a seminar on corporate adoption and said beforehand that professionals from more than 1,400 firms were expected to join.

"Bitcoin as a corporate treasury asset is not yet a mainstream business strategy, but firms like MicroStrategy and now Tesla are highly visible advocates," said Seamus Donoghue, vice president of sales and business development at digital infrastructure provider Metaco. "With such vocal sponsors leading corporate adoption, further adoption will follow much faster than currently expected."

Some sectors may warm to bitcoin more quickly than others, with tech firms and financial companies likely to be more disposed to the idea of digital currencies, according to Fundstrat.

"I wouldn't be surprised to have an announcement from some of the tech giants Facebook or Google within the year," said Amber Ghaddar, founder of fintech firm AllianceBlock. "But I think the road is still long for the more traditional treasurers."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.