Technology giants led by Apple Inc. and Microsoft Corp. disclosed more than $100 billion in profit outside the United States in their most recent fiscal years, making them prime targets of President Joe Biden's proposals to boost taxes on earnings stashed overseas.

The tax proposals, unveiled this month to help foot the bill for massive infrastructure plans, target common tactics used by U.S. multinationals such as stashing income-generating assets in low-tax offshore jurisdictions. The tech industry is particularly adept at shifting profits to tax-friendly locales because its main assets—software code, patents, and other intellectual property —are relatively easy to move around compared with factories and physical assets.

Former President Donald Trump's 2017 Tax Cuts and Jobs Act was supposed to crack down on offshore tax maneuvering, but Republicans neutered the rules by adding extra deductions and other benefits, according to Andrew Silverman, a tax policy analyst at Bloomberg Intelligence.

Recommended For You

Big Tech will find it harder to dodge Biden's plan because, if turned into law, it would close most of the loopholes left by Trump's 2017 legislation. The move threatens to leave the industry further at odds with Washington, where lawmakers are already scrutinizing the spread of misinformation on online platforms and regulators are embarking on antitrust investigations into large tech companies.

"Biden's proposals may accomplish what the Tax Cuts and Jobs Act promised but failed to deliver: higher taxes on large U.S. technology companies," said Silverman, who has previously advised corporations on these strategies. "For some companies, there will be a huge impact."

One yardstick to estimate possible exposure, according to Silverman, is examining the regulatory filings of large U.S. tech companies such as Apple, Microsoft, Amazon.com Inc., Facebook Inc., Intel Corp., and Alphabet Inc. Those six corporations disclosed more than $100 billion in overseas pretax income in their most recent financial years. Today, the first of these companies, Intel, reports first-quarter earnings that are expected to top $4 billion.

The tax plan has divided opinion among executives: Amazon chairman Jeff Bezos says he supports higher corporate taxes, while Intel boss Pat Gelsinger criticized Biden's plan after a recent meeting at the White House to discuss bringing semiconductor manufacturing back to the United States. "We're trying to step forward in a dramatic way, a decade-shaping way," Gelsinger said. "Now is not the time to tell me, 'I'm going to give you a buck over here and take two bucks over there.'"

Three specific Biden proposals have the potential to add billions of dollars to the annual tax bills of U.S. tech companies, based on the analysis of regulatory filings. All of the companies declined to comment on the proposed tax measures when contacted by Bloomberg.

Global Minimum Tax Rate

Trump's 2017 U.S. tax law included a levy on global intangible low-taxed income, or GILTI, which taxes profits generated in foreign countries using intangible assets such as intellectual property (IP) and software code.

This targeted a common tactic among large tech companies: They transfer their IP to Bermuda or other low-tax locations, and then the Bermuda entity charges the company's subsidiaries in high-tax locations, such as France, for using the IP. This way, the business units in higher-tax jurisdictions technically make no profit and so pay very little tax.

"It's simpler to move your intangible asset than machinery," according to Daniel Bunn, vice president of global projects at the Washington-based Tax Foundation.

Biden wants to raise the GILTI tax rate from 10.5 percent to 21 percent, and he wants to limit the use of foreign tax credits, according to Silverman. The Tax Foundation, a right-leaning think tank, estimates the proposed changes to GILTI could increase corporate tax bills by almost $300 billion over a decade. Much of that cost would likely fall on the tech sector.

For example, Microsoft's annual GILTI tax bill would potentially more than double, to $2 billion, under Biden's proposal, Silverman estimates. In its 2020 fiscal year, Microsoft got 86 percent of its foreign pretax income from operations in Ireland and Puerto Rico, which have lower corporate tax rates than the United States, according to the company's annual report.

Repeal of FDII

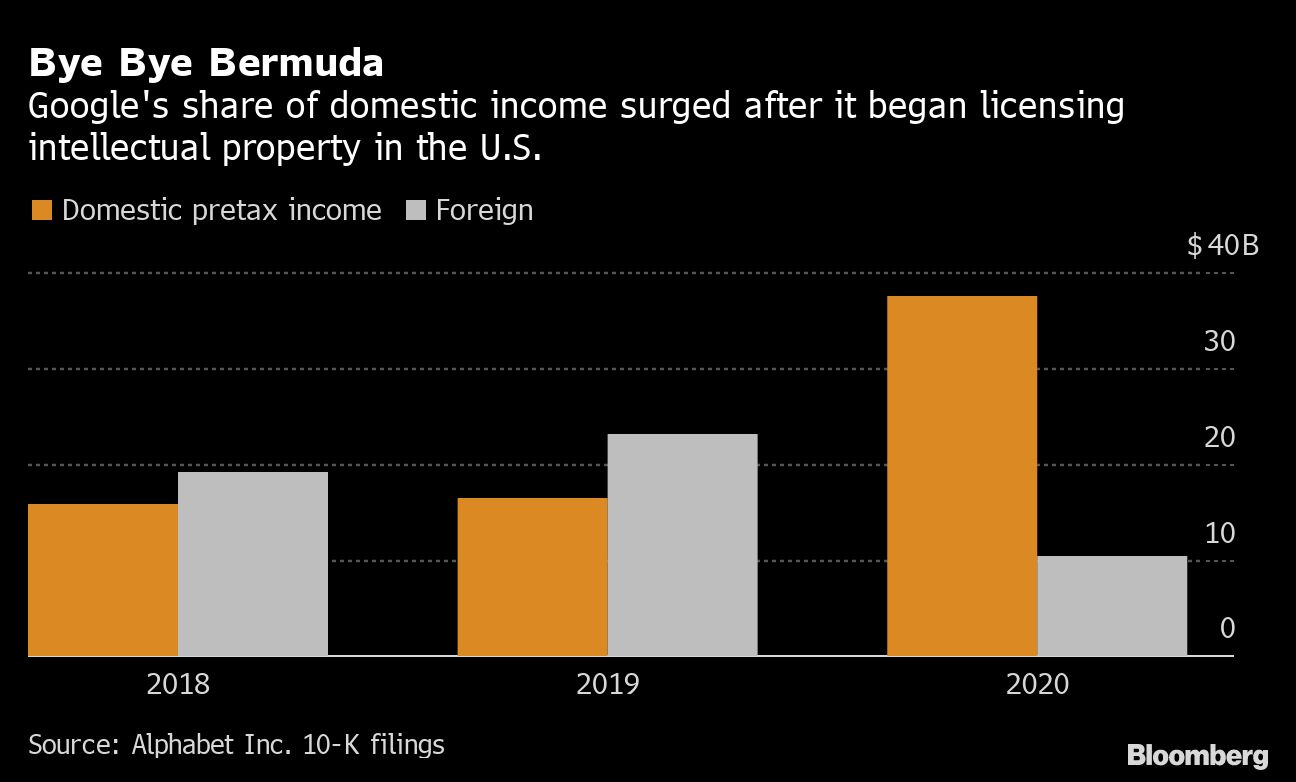

The 2017 tax law also offered a tax deduction for foreign derived intangible income, or FDII. It was designed to encourage American companies to keep intangible assets, such as IP, in the U.S. or to bring these assets home from overseas. Alphabet did just that at the end of 2019 when it started licensing in the United States IP that had been previously licensed in Bermuda. Facebook made a similar change.

Now, Biden is proposing to repeal FDII, which would likely increase the tax bills of tech companies, according to Bunn. Amazon took total FDII deductions of almost $500 million in 2018, 2019, and 2020 combined, according to its latest annual report. "You might see some companies rethink holding in intellectual property in the U.S. if this tax break goes away," said Bunn.

Minimum Book Tax

Finally, there's a proposal in Biden's plan to introduce a 15 percent "minimum book tax" on large corporations that report high profits but have little taxable income. Big U.S. tech companies often have low effective tax rates due to a slew of available deductions for items including research and development, foreign credits, and stock-based compensation.

"The biggest impact for tech companies is this minimum tax on book income," said Bunn. "This would likely hit some companies much harder than the current tax system."

If Biden's book tax existed in 2020, Google's bill would've been $847 million higher. Amazon would've owed an additional $1.2 billion and Apple another $3.8 billion, according to Silverman's estimates.

Tech companies are also facing scrutiny from outside the United States. Global talks, led by the Organization for Economic Co-operation and Development (OECD), are trying to address many countries' concerns that tech giants—and other multinationals—aren't being properly taxed under the current system. The OECD effort seeks to replace the digital services taxes that a growing number of countries are enacting to capture more revenue from companies like Google and Facebook. However, Amazon, which would likely escape the new rules as its margins are so thin, is becoming a roadblock in those negotiations.

—With assistance from Laura Davison, Tom Contiliano & Ian King.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.