The U.S. labor market got back on track last month with a larger-than-forecast and broad-based payrolls gain, indicating greater progress filling millions of vacancies as the effects of the Covid-19 delta variant faded.

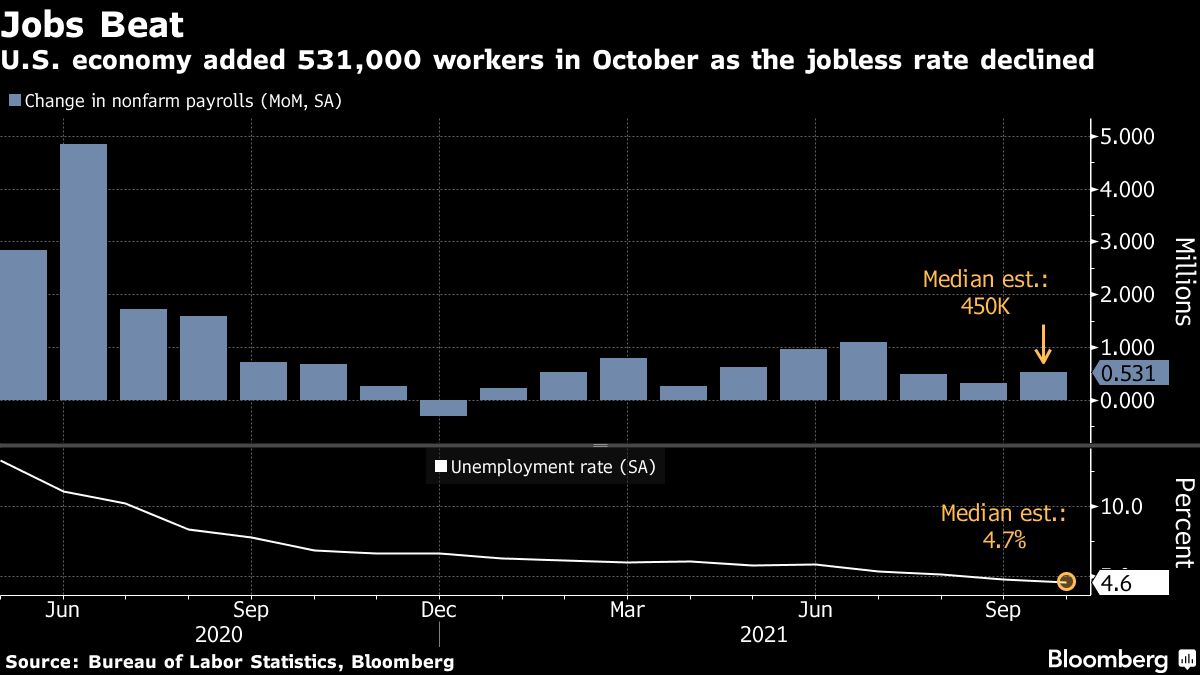

Non-farm payrolls increased 531,000 last month after large upward revisions to the prior two months, a Labor Department report showed Friday. The unemployment rate fell to 4.6 percent while the labor-force participation rate was unchanged.

Recommended For You

Payroll gains last month were led by a 164,000 increase in leisure and hospitality. Professional and business services, transportation and warehousing, and manufacturing also posted significant advances. Hiring at temporary help services rose the most since February, indicating companies are having success luring workers for the holiday-shopping season.

Factory employment jumped by 60,000 in October, the most since June of last year and largely reflecting a surge in automakers' payrolls. That, combined with job gains in transportation, could help ease supply-chain bottlenecks. At the same time, state and local government education payrolls slipped, weighing on broader public sector employment.

The data paint a sunnier picture of the job market than previously thought, with easing Covid-19 cases and higher wages helping employers fill near-record openings. At the same time, the labor-force participation rate has barely budged in recent months as millions of Americans remain on the sidelines.

The figures help validate the Federal Reserve's decision this week to begin scaling back its pandemic-era pace of bond-buying aimed at keeping borrowing costs ultra-low. They may also give a boost to President Joe Biden as his approval ratings sag and he struggles to get more than $2 trillion in tax and spending proposals through Congress.

The median estimate in a Bloomberg survey of economists called for a 450,000 payrolls gain and for the jobless rate to fall to 4.7 percent. U.S. stocks advanced, and the yield on the 10-year Treasury note declined.

Average hourly earnings rose 4.9 percent in October from a year ago, the most since February, though inflation is taking a bigger bite out of workers' paychecks. The increase underscores workers' ability to demand higher pay amid an ongoing labor shortage.

"The only thing missing now is an upturn in participation as the market tightens and wages rise further," Sal Guatieri, senior economist at BMO Capital Markets, said in a note. "Continued weakness in participation will only grease the jobless rate's decline—which could very well lead to a faster pace of tapering and earlier rate hikes."

Higher wages could mean that more businesses raise prices to protect margins as the costs of labor, materials, and transportation climb, stoking inflation. Prices have increased by the most in three decades on a year-over-year basis, driven by supply-chain disruptions and shortages.

"We have high inflation, and we have to balance that with what's going on in the employment market," Fed Chair Jerome Powell told reporters on Wednesday following the central bank's policy meeting. "It's a complicated situation."

What Bloomberg Economists Say…

"With the unemployment rate inching down and wages continuing to climb, this job report checks the Fed's boxes to indicate the economy is on track to attain their lowered bar for maximum employment, which recognizes that participation rates may not return to their pre-pandemic level by mid-2022."

—Anna Wong, Andrew Husby & Eliza Winger

October's gain leaves U.S. payrolls 4.2 million below their pre-pandemic level. The pace of hiring in the coming months risks being restrained by new Covid flare-ups. Recent data show hospitalizations increasing in 13 states, which could signal another virus wave. Healthcare payrolls climbed in October by the most this year, led by home healthcare and nursing.

The Labor Department's report showed that the average workweek fell to 34.7 hours in October from 34.8 hours a month earlier.

The stagnant labor-force participation rate—the number of Americans either employed or looking for work—points to challenges with getting people back into jobs. Participation has remained near current levels since August of 2020, due in part to increased retirements and parents leaving jobs for child care purposes.

"There is still ground to cover to reach maximum employment, both in terms of employment and in terms of participation," Powell said Wednesday.

Unemployment rates for White and Hispanic Americans dropped in October, while the Black and Asian rates were unchanged.

Through the Corporate Lens

"Certainly, the higher wages that you pay, it allows you to stay competitive, but we're also seeing that is just, it's very challenging right now in the market to find the level of talent that you need." —McDonald's Corp. CEO Chris Kempczinski, Oct. 27 earnings call

"U.S. labor availability remains tight across most industries, driving wage inflation and staffing challenges that have resulted in a small number of our stores limiting operating hours." —Yum! Brands Inc. CFO Chris Turner, Oct. 28 earnings call

"It does feel like there's more options for hourly employment, and because of that, that's putting pressure on the labor markets and hiring for the roles that we need." —Kimberly-Clark Corp. CEO Michael Hsu, Oct. 25 earnings call

—Written with assistance from Kristy Scheuble, Reade Pickert, Ana Monteiro, Sophie Caronello, Sydney Maki, Scott Lanman & Michael McDonough.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.