Wall Street's main regulator received more tips on corporate wrongdoing than ever before as employees became more confident to report on misdeeds after working away from the office for more than a year.

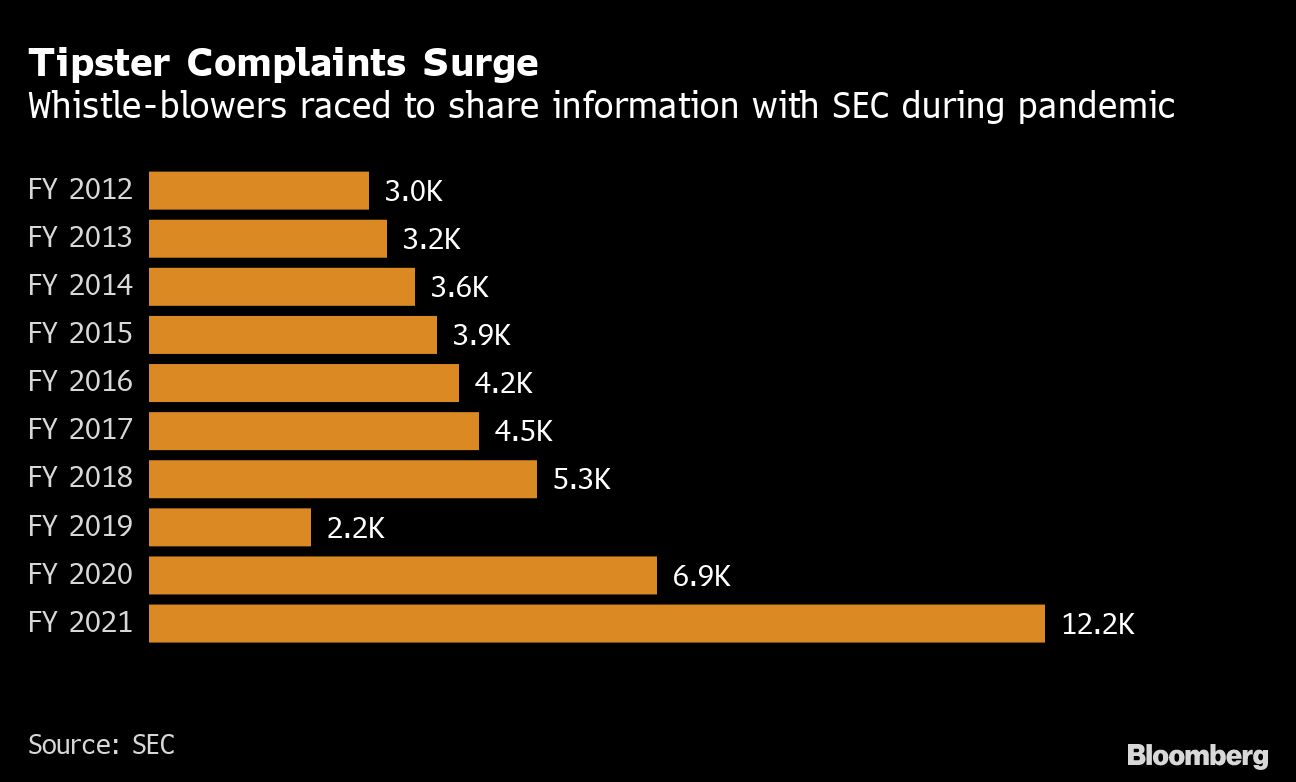

The U.S. Securities and Exchange Commission (SEC) received more than 12,000 whistleblower tips in the fiscal year that ended on September 30, almost double the previous record set last year, according to the agency's annual whistleblower report published Monday. The jump in tips coincides with much of corporate America working from home during the pandemic.

Recommended For You

Being away from the office has led workers to question how dedicated they are to their employers, according to academics and whistleblower attorneys. Tipsters can more easily report on their colleagues' activities without worrying about whether co-workers are peering over their shoulders or managers are tracking their actions.

"People feel safer at home to collect and report wrongdoing," said Jordan Thomas, a former SEC official who helped set up the agency's whistleblower program a decade ago. "No one is watching them take pictures of their computer, and no one knows they're recording a conference call with their phone."

Also luring informants is the potential for a massive payout. The SEC awarded about $564 million to 108 individuals over the past year, including granting one tipster $114 million for information that led to a successful enforcement action. In fact, the watchdog gave out more awards last year than in all prior years combined, according to the report.

Under the SEC program, which was established as part of the 2010 Dodd-Frank Act in the wake of the financial crisis, tipsters can receive financial awards if they voluntarily provide unique information that results in an enforcement action. Payouts can range from 10 percent to 30 percent of the money collected in cases where sanctions exceed $1 million. Awards are paid via a fund set up by Congress—not money owed to harmed investors.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.