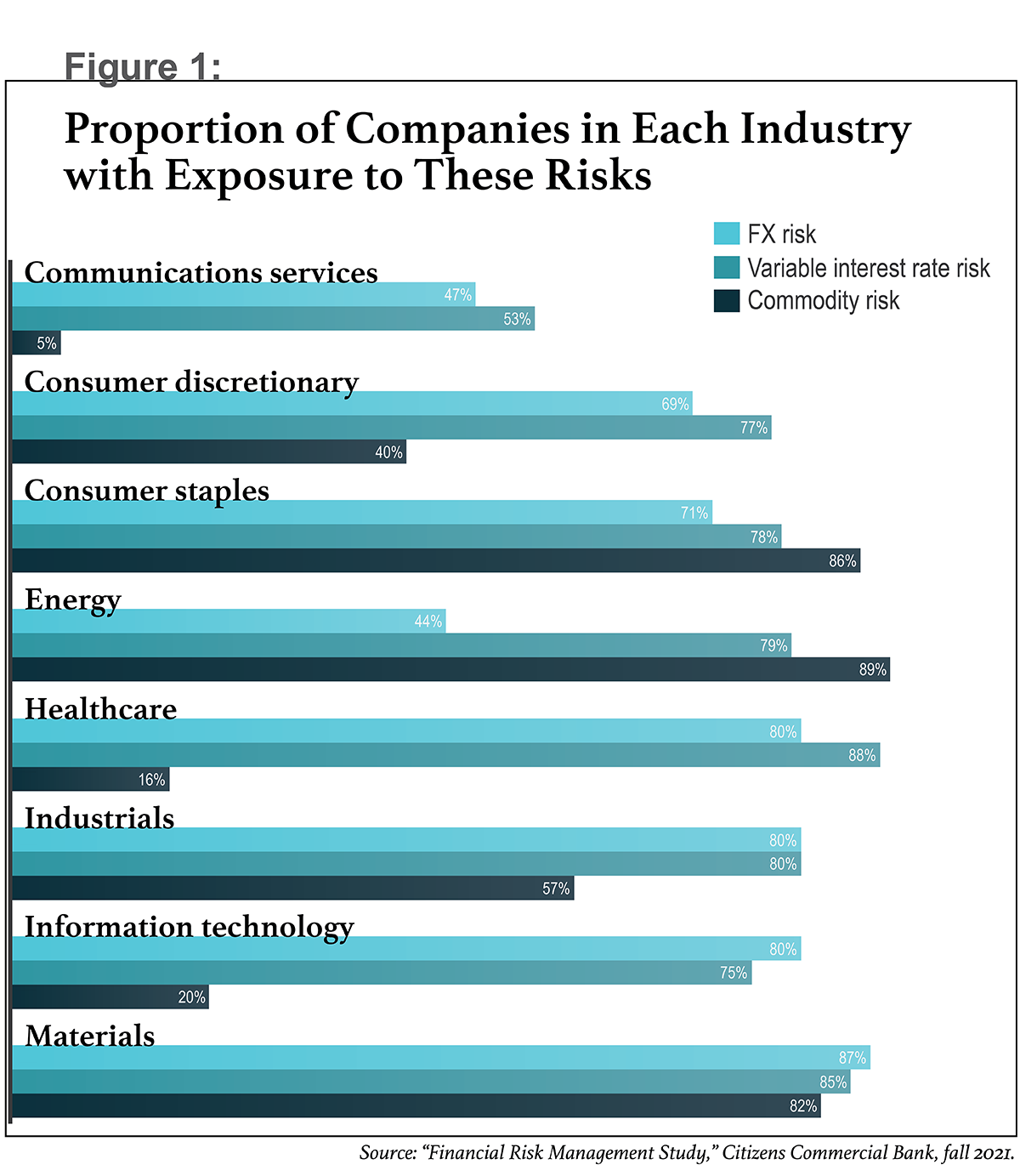

In a complex and interconnected world, risks are everywhere. Companies that fail to effectively mitigate the highest-impact risks may find they wreak havoc on financial projections, budgets, and the company's ability to meet stakeholder expectations. A recent Citizens Commercial Bank Risk Management Study of 350 U.S. publicly listed companies revealed how widespread these risks are: 78 percent of respondents said their organization is exposed to interest rate risk, 74 percent to foreign exchange (FX) risk, and just under 50 percent to commodity risk. Yet only about half of these companies are adequately managing their risk exposures, which hurts their planning processes.

Risk exposures vary by industry. For example, companies in the healthcare, industrials, and materials sectors are capital-intensive and are traditionally heavier borrowers, relatively speaking. As a result, companies in these sectors are much more exposed to changes in interest rates over time. (See Figure 1.)

Recommended For You

The size of a company's exposure to FX risk generally depends on how much of its business is transacted overseas vs. domestically. But other factors can come into play. The U.S. energy sector, for example, is protected from FX risk because international oil and refined products, such as gasoline and diesel, are traded in U.S. dollars at the wholesale level.

.

Basics of Interest Rate Hedging

Our study found that 78 percent of companies are exposed to interest rate risk. Worse, many of these have exposures to floating-rate debt tied to the London interbank offered rate (LIBOR). Only 51 percent of all respondents are hedging interest rate risk—i.e., converting the variable-rate liability to a fixed-rate liability via a financial instrument such as an interest rate swap. This is understandable, considering the exceptionally low interest rate environment of recent years. But it is not a sound long-term strategy.

Now that rates have begun to rise, unhedged positions have become riskier. Market sentiment is shifting toward an increasing desire to hedge. Another issue is the uncertainty as the industry phases out LIBOR. Most banks have stopped issuing loans tied to LIBOR, and LIBOR will cease to be quoted in 2023. This may make hedging existing LIBOR-linked loans challenging.

For those companies that face significant interest rate risk, there are four commonly used hedging tools:

- Swap. A swap is a contract in which one stream of future interest payments is exchanged for another. These usually involve the exchange of a fixed interest rate for a floating rate, or vice versa, to reduce or increase exposure to fluctuations in interest rates.

- Cap. An interest rate cap establishes a ceiling on interest payments. It is a series of call options on a floating interest rate index, usually three- or six-month LIBOR, which coincides with the rollover dates on the borrower's floating liabilities. (A call option is an option to buy assets at an agreed-upon price, on or before a particular date.)

- Floor. A minimum interest rate created using put options, which are options to sell assets at an agreed-upon price on or before a particular date.

- Collar. The simultaneous purchase of an interest rate cap and sale of an interest rate floor on the same index for the same maturity and notional principal amount. These contracts protect against rising interest rates and set a floor on declining interest rates.

The Citizens survey found that, among those respondents whose companies are hedging interest rate risk, 91 percent use interest rate swaps, with a smaller proportion using options such as interest rate collars (13.5 percent) or caps.

Many companies hedge 50 percent to 60 percent of their interest rate exposure, keeping about half of their debt floating-rate. This neutral approach gives them the ability to benefit if interest rates stay low. But with rates so low, and a hedged position relatively inexpensive, some companies prefer the peace of mind of having a fully hedged position. This "all-in" rate perspective brings even greater certainty to their financial planning and budgeting process.

.

FX Risk Is Growing

FX risk is the financial exposure that companies face when they are not protected from potential changes in foreign exchange rates. This exposure can lead to decreased profitability, missed targets, and/or significant losses. Companies frequently use forwards—contracts that lock in the current exchange rate for the purchase or sale of currency on a given future date—to hedge the risk that unexpected FX shifts may impact their financials.

Increasing globalization has made currency risk an issue for businesses of all sizes. Indeed, the Citizens study found that FX risk is nearly as prevalent as interest rate risk. Almost three-quarters of the companies we analyzed have exposure to FX risk, yet just 54 percent of all respondents are managing that risk through hedging. There are several possible reasons for this. One is that management is sometimes uncertain about the extent of the company's FX exposure. Another is a lack of familiarity with various hedging tools.

Perhaps the biggest reason why almost half of companies with FX risk do not hedge those exposures is that many companies simply fail to realize they have an exposure to currency risk, either because it's crept in as the business has grown (organically or through acquisitions) or because they're not fully aware of contractual terms that allow customers and suppliers to reprice goods and services. Although interest rate risk is fairly obvious, FX risk can remain hidden.

For example, a company might start out small, using only domestic suppliers. Over time, as it grows, the business might tap into the global supply chain. The company might begin working with foreign suppliers by insisting that all its overseas transactions must be denominated in U.S. dollars, but later may recognize the benefits of buying and selling in foreign currencies. Its overseas customers may prefer to make purchases in their local currencies, since that reduces the complexity of the transaction for them. On the procurement side, the company may come to understand that requesting invoices and making payments in suppliers' currencies will provide more precise information about what it's paying, and will thus give the procurement function more control of purchasing processes in general.

Hedging this new risk is an important way to bring more certainty to the financial planning and budgeting process. The Citizens survey found that, among those respondents that are hedging FX risk, forwards are the most popular method. However, more advanced strategies are also gaining traction, with 27 percent of companies using cross-currency swaps and 22 percent choosing options. (See Figure 3.)

.

Commodity Risks May Be Difficult to Hedge

Commodity risk is the least prevalent of the risks we studied. Just 49 percent of companies are exposed to commodity risk—with most of those exposures tied to energy, as opposed to metals and/or agricultural products—and only 31 percent of companies are hedging that risk.

These findings make sense considering the relative decline in the share of industrial, manufacturing, and other commodity-consuming sectors in the U.S. economy. Even for companies in commodity-dependent industries, commodity exposures are often difficult to hedge, because the highly fragmented markets result in multiple underlying price indices, which aren't always hedgeable.

The percentage of companies hedging their commodity risk may soon increase if commodity prices and volatility continue to spiral upward. Oil prices, which briefly traded in negative territory during the pandemic, are north of $100 per barrel as of this article's writing. At the same time, natural gas prices rose so high in Europe last fall that some factories shut down. If these events are any guide, commodity volatility will persist even as the global economy continues to shift from fossil fuels to green energy.

Thus, senior leaders have recently been paying more attention to commodity risk. Unlike interest rate and FX risk, which are handled by the CFO or treasurer, commodity risk is typically handled lower down the corporate structure, by the procurement department. But now companies that are big consumers of energy—such as makers of cement, steel, and fertilizer—are beginning to elevate these discussions to the executive suite. And many other companies are suddenly realizing the true extent of their energy exposure, especially businesses that have large fleets of vehicles or that rely on other companies for transportation.

.

How to Revisit Your Hedging Strategy

Whether or not a treasury team has historically used derivatives hedges to mitigate financial risks, now is an excellent time to examine some of the long-held assumptions that have guided those decisions. Key questions to ask include:

- Do we have a full understanding of the risks our company is exposed to, whether interest rate, foreign exchange, and/or commodity risk?

- Are we correctly factoring these risks into our planning processes?

- Are our current risk management and mitigation activities adequate to handle the risks our company faces today and will face in the future?

- Do we have the right risk management capabilities in-house to meet today's challenges?

As part of the budgeting and financial planning processes, treasury groups should assess the company's risk exposures with the goal of uncovering untapped areas of opportunity or hidden risks. The more risk a company can take off the table, the more likely it is to achieve its financial plans and meet the expectations of stakeholders. Engaging a partner with hedging expertise to assess these risks can be an important first step toward setting up a new risk management strategy.

.

Rich Aidala is the co-head of global markets at Citizens. Since joining the bank in 2007, Rich has held a variety of roles, including head of sales for global markets.

Rich Aidala is the co-head of global markets at Citizens. Since joining the bank in 2007, Rich has held a variety of roles, including head of sales for global markets.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.