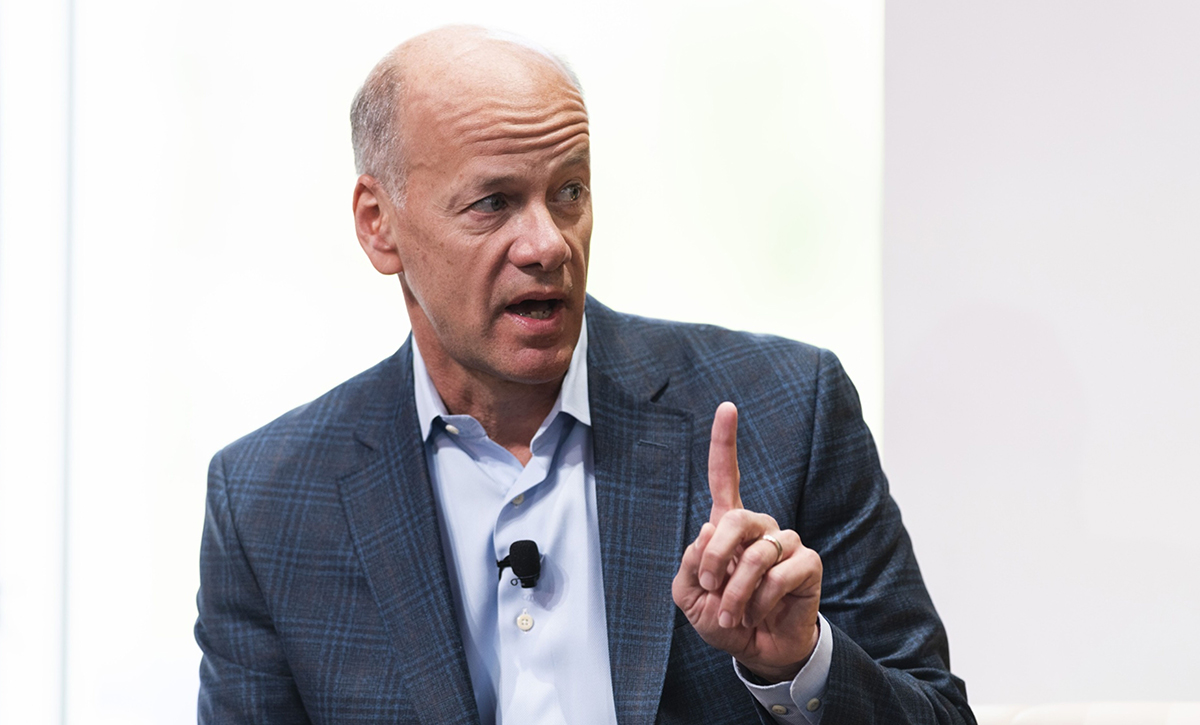

Greg Becker, former CEO, Silicon Valley Bank

Greg Becker, former CEO, Silicon Valley Bank

Key U.S. senators blamed former senior managers at Silicon Valley Bank (SVB) and Signature Bank for the lenders' spectacular collapse in March, a bi-partisan rebuke of executives already facing intense scrutiny in Washington.

Sherrod Brown, a Democrat who leads the Senate Banking Committee, and Tim Scott, the top Republican on the panel, kicked off an oversight hearing on Tuesday united in their criticism. Greg Becker, ex-CEO of Silicon Valley Bank, and Scott Shay, who served as chairman of Signature Bank, were among those testifying.

Recommended For You

"We know your banks were fatally mismanaged," Brown said. "The next obvious question is why—why did you let things get this bad? Why did you ignore admonitions from regulators? To that question, too, there is a simple answer—the same answer we find to most questions about big banks' failures: because the executives were getting rich."

Becker, the ex-CEO of SVB, has drawn ire from both Democrats and Republicans for selling $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses. He said his average annual compensation was around $10 million.

On Tuesday, Becker said the stock sales were approved by the bank's legal team. He also defended his pay and said there was "nothing irregular or accelerated" about bonuses certain employees received for 2022 performance shortly before the bank was seized. However, when pressed, he declined to say whether he'd give back any of his pay, although he added that he would cooperate with regulators.

The hearings in Washington, which also feature top banking regulators testifying before the House Financial Services Committee, are the latest twist in a months-long saga that has taken down four midsize lenders and has put Americans on edge over the banking system. In addition to leadership at the firms, some have blamed U.S. watchdogs for not doing more to prevent the turmoil.

Senator Bob Menendez questioned whether Becker and other executives traded on material non-public information when they sold a total of about $84 million in company stock over the past two years. The New Jersey Democrat specifically mentioned dozens of findings from regulators that pointed out risks and issues at the bank. "I didn't believe it was," Becker said in response.

Lawmakers blasted executives from both Signature Bank and SVB for not taking more responsibility. Becker, Shay, and Eric Howell, Signature's former president, all said the runs at the firms were caused by unprecedented events, rather than mismanagement.

Becker sought to cast blame on regulators for the bank's demise. He argued that the fast pace of interest-rate hikes by the Federal Reserve and negative social media commentary helped fuel the collapse.

"The messaging from the Federal Reserve was that interest rates would remain low and that the inflation that was starting to bubble up would only be 'transitory,'" Becker said. Instead, it pursued hikes that would become "the steepest rate increase over a 12-month period in almost 40 years," he said.

Yet there were plenty of analysts who warned the Fed could be making a big mistake that would ultimately lead to those rapid rate increases. In fact, inside SVB itself, there were bankers raising such concerns. In late 2020, the firm's asset-liability committee received an internal recommendation to buy shorter-term bonds as more deposits flowed in.

Such a shift would have reduced the losses SVB sustained when rates soared two years later, but executives balked at the cost at the time and opted to keep plowing cash into long-term securities.

Scott, the Senate Banking Committee's top Republican, said bank executives should have known better. "Anyone that paid close attention to the economy over the past two years could have plainly seen that the Federal Reserve was going to continue to increase interest rates," he said. Scott also said regulators should have stepped in sooner. "Our banking regulators were utterly asleep at the wheel," he said.

Reports from the Fed and Federal Deposit Insurance Corp. (FDIC) released last month said mismanagement was the root cause of the bank failures, but government officials have acknowledged that regulators bear some of the responsibility.

Michael Barr, the Federal Reserve's vice chair for supervision, said in testimony for the House Financial Services Committee that regulators "must do better." He also said he wants more oversight of executive compensation in the wake of the bank failures.

FDIC Chairman Martin Gruenberg, National Credit Union Administration Chairman Todd Harper, and Acting Comptroller of the Currency Michael Hsu are also testifying. Tuesday is the first of three days of oversight hearings. Lawmakers in the Republican-led House will get a crack at the former executives on Wednesday, and the Senate committee, which is controlled by Democrats, will query the regulators on Thursday.

On Tuesday, Barr reiterated that he planned to strengthen enforcement by hitting banks with short-term penalties, such as limitations on stock buybacks, if they don't act quickly on safety and soundness issues.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.