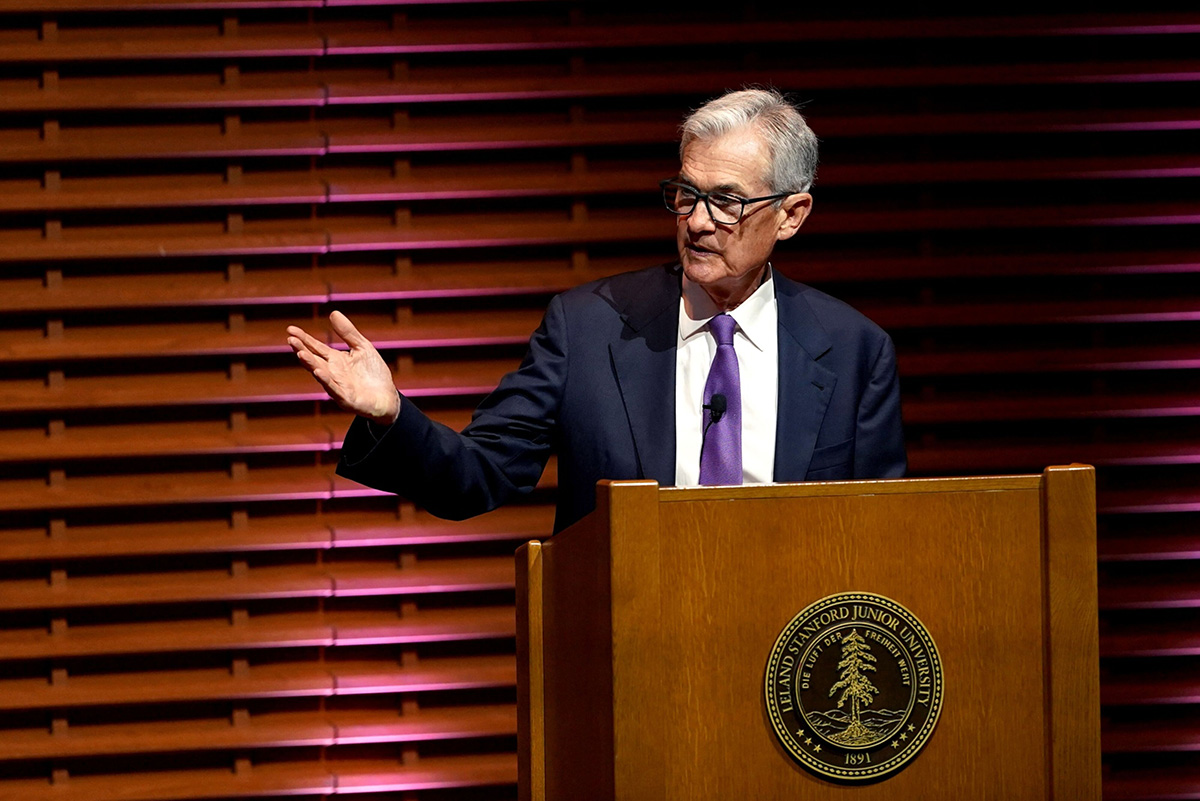

Jerome Powell, chairman of the U.S. Federal Reserve, speaks during Stanford's 2024 Business, Government, and Society forum in Stanford, California, on April 3, 2024. Photographer: Loren Elliott/Bloomberg

Jerome Powell, chairman of the U.S. Federal Reserve, speaks during Stanford's 2024 Business, Government, and Society forum in Stanford, California, on April 3, 2024. Photographer: Loren Elliott/Bloomberg

Federal Reserve Chair Jerome Powell signaled that U.S. central bankers will wait longer to cut borrowing costs following a series of surprisingly high inflation readings, which reduces room for easier policy around the world.

Global finance chiefs convening in Washington for the International Monetary Fund (IMF)–World Bank spring meetings are sweating the strength of the U.S. economy, as elevated interest rates and a strong dollar force other currencies lower and complicate plans to bring down borrowing costs.

Recommended For You

Meanwhile, an escalation of the conflict in the Middle East is raising concerns of a wider regional war that could send oil prices over US$100 a barrel.

Here are some of the charts that appeared on Bloomberg last week related to the latest developments in the global economy, geopolitics, and markets:

The high tide for global interest rates has passed, but respite for the world economy may be limited as policymakers stay wary at the threat of inflation. Powell's latest pivot creates a quandary for central bankers around the world.

The IMF inched up its expectations for global economic growth this year, citing strength in the U.S. and some emerging markets, while warning that the outlook remains cautious amid persistent inflation and geopolitical risks.

The increasingly hopeful economic story of 2024 so far is that of a world headed for a soft landing. Unfortunately, that same world is also becoming more dangerous, divided, indebted, and unequal.

In the United States, retail sales rose by more than forecast in March, and the prior month was revised higher, showcasing resilient consumer demand that keeps fueling a surprisingly strong economy. So-called "control-group sales"—which are used to calculate gross domestic product—jumped by the most since the start of last year.

Meanwhile, as President Joe Biden last week hailed America's booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: Cool it. While the world's largest economy is helping support global growth, it also means the U.S. is "slightly overheated," according to the IMF's Kristalina Georgieva—thanks in part to Washington's fiscal stance, with the budget gap pushing toward 7 percent of GDP.

Israel reportedly struck back at Iran on Friday morning, following days of frantic diplomacy from the United States and European nations, in which they tried to convince Israeli Prime Minister Benjamin Netanyahu not to respond too aggressively, if at all, to the Iranian attack. Their main concern is to avoid a wider war in a region already roiled by the Israel-Hamas conflict—a war that could send oil prices above $100 a barrel.

India forecast an above-normal monsoon this year, raising optimism that ample rains will spur crop output and economic growth, as well as prompt the government to ease curbs on exports of wheat, rice, and sugar. Forecast of a normal monsoon bodes well for easing food costs, and headline consumer price inflation eventually, said Anubhuti Sahay, head of economic research, South Asia, at Standard Chartered Plc.

European Commission president Ursula von der Leyen is unleashing a barrage of trade restrictions against China as she seeks to follow through on a pledge to make the European Union (EU) a more relevant political player on the global stage. Clean tech is the area where the EU is most fervently fighting to stave off competition from cheap Chinese imports of everything from electric vehicles (EVs) to solar panels.

UK inflation slowed less than expected last month as fuel prices crept higher, prompting traders to further unwind bets on how many interest rate cuts the Bank of England will deliver this year.

Finally, China reported faster-than-expected economic growth in the first quarter—along with some numbers that suggest things are set to get tougher in the rest of the year. Gross domestic product climbed 5.3 percent in the period, accelerating slightly from the previous quarter and beating estimates. But much of the bounce came in the first two months of the year. In March, growth in retail sales slumped and industrial output fell short of forecasts, suggesting challenges on the horizon.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.