Companies worldwide are bracing themselves for a year of increased uncertainty, driven by growing concerns over political, legal and regulatory developments around the globe.

The sixth annual Allianz Risk Barometer identifies the top corporate perils and potential responses for 2017 based on the insights of more than 1,237 risk experts from 55 countries.

“Companies worldwide are bracing for a year of uncertainty,” said Chris Fischer Hirs, CEO of Allianz Global Corporate & Specialty SE. “Unpredictable changes in the legal, geopolitical and market environment around the world are constant items on the agenda of risk managers and the C-suite. A range of new risks are emerging beyond the perennial perils of fire and natural catastrophes which require re-thinking of current monitoring and risk management tools.”

Related: Is the world getting riskier? Consumers and businesses disagree

The Allianz Risk Barometer study was conducted among Allianz corporate clients and brokers last October and November. It also surveyed risk consultants, underwriters, senior managers and claims experts of Allianz entities around the globe. The survey focused on large and small to mid-sized companies.

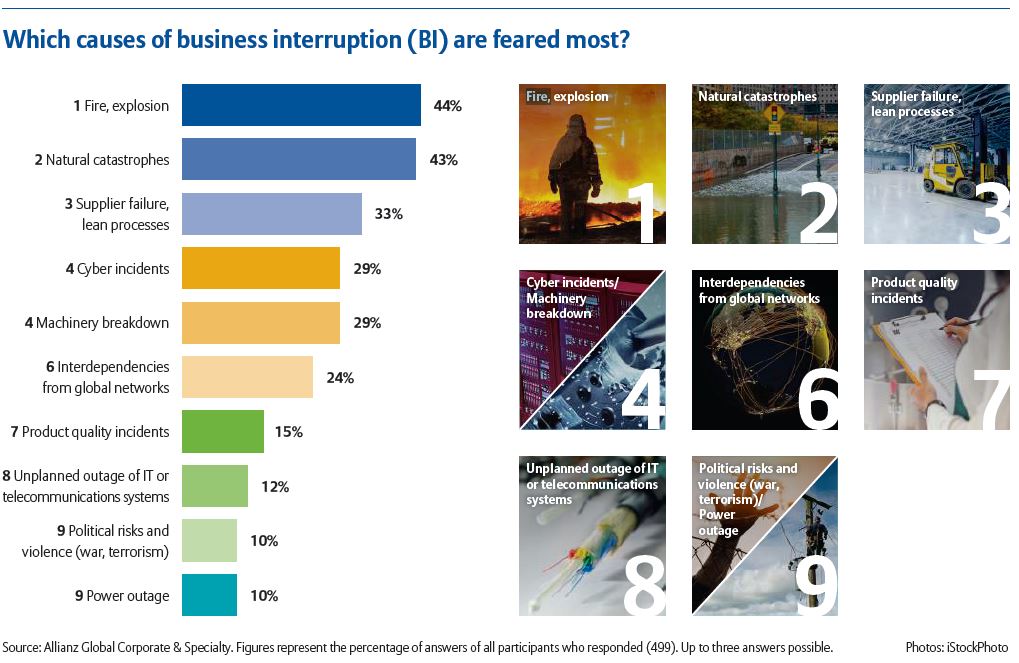

Here are the top 10 corporate perils for 2017, according to the survey:

(Photo: iStock)

10. New technologies (12 percent; 2016: 10 percent)

(e.g. impact of increasing interconnectivity, nanotechnology, artificial intelligence, 3D printing, drones, etc.)

Increasing reliance on technology and automation is transforming and disrupting companies across all industry sectors. While digitalization is bringing companies new opportunities, it's also shifting the nature of corporate assets from mostly physical to increasingly intangible, bearing new hazards.

Technical IT failure or human error can result in costly damages. The digitalized production or Industry 4.0 environment means failure to interpret or submit data correctly can halt production.

More than half of Risk Barometer responses (53 percent) cited increasing digitalization and use of new technologies as the most prominent trend currently transforming their respective industry sector.

(Photo: iStock)

9. Loss of reputation or brand value (13 percent; 2016: 18 percent)

A key trend, especially in Asia, is the rise in product recall claims. This risk impacts supply chains and brand value of companies. Also, a single cyber incident can cause widespread reputational damage.

(Photo: iStock)

8. Political risks and violence (14 percent; 2016: 11 percent)

(war, terrorism, etc.)

Companies increasingly worry about the unpredictable business environment where markets are volatile and political perils, such as terrorism, are on the rise.

Terrorism risk ranks as the number one concern for businesses in the political risk and violence category. Terrorism resulted in 29,376 deaths and cost the global economy $89.6 billion in 2015, according to the 2016 Global Terrorism Index from the Institute for Economics & Peace.

Related: Terrorism risk insurance: Trends, take-up & pricing

Terrorism risk is rising and a business does not have to be the direct victim of an act to feel the effects. Locations can become inaccessible and supply chains impacted in the wake of an attack.

The growing risk of political violence, acts such as war, civil war, insurrection and other politically motivated incidents, which focus on countries rather than certain locations, should also not be underestimated, as the impact for global businesses can be much greater and longer-lasting.

(Source: Allianz Risk Barometer Top Business Risks 2017)

7. Fire, explosion (16 percent; 2016: 16 percent)

Physical perils like fire and explosion and natural catastrophes are the top causes of business interruption that businesses fear most.

Recent events, such as the wildfires in Fort McMurray, Alberta, have highlighted the fire and explosion risk companies face.

Related: Alberta wildfire costliest insured disaster ever in Canada

(Photo: iStock)

6. Macroeconomic developments (22 percent; 2016: 22 percent)

(austerity programs, commodity price increase, deflation, inflation)

Fears over macroeconomic developments and the new risk impact of increasing interconnectivity are rising.

There are significant local and regional differences in the top 10 risks around the world. Market and macroeconomic developments rank as the top two risks in the Africa & Middle East region. Macroeconomic developments dominate in Nigeria.

Macroeconomic concerns also continue to dominate in Greece.

“It's no longer only about managing effects from economic cycles on your top line growth or revenue base, it's preparing for potentially very abrupt and massive changes which may impact the way you do business,” explains Ludovic Subran, head of Euler Hermes Economic Research, deputy chief economist of Allianz Research and director of Macroeconomic Research.

(Photo: iStock)

5. Changes in legislation and regulation (24 percent; 2016: 24 percent)

(government change, economic sanctions, protectionism, etc.)

Businesses are increasingly concerned about the ongoing uncertainty, and potential intangible risks, posed by the changing legal and political environment around the globe.

Changes in legislation and regulation, political risks and violence and Brexit, Euro-zone disintegration, rank higher year-on-year, accounting for over 40 percent of responses collectively.

Fear of protectionism or government intervention in business is perceived to be an increasing threat, leading to worries over access to markets and import and export restrictions; presenting a potential business interruption threat of a different kind.

Companies will need to invest more resources into better monitoring politics and policy-making around the world in order to gather the economic intelligence that will enable them to anticipate, and adapt to, any sudden changes of rules that could impact business models, amid fears of increasing protectionism and anti-globalization.

Tokio Miyamoto examines the damage of houses collapsed by earthquakes in Aso, Kumamoto prefecture, Japan, Sunday, April 17, 2016. Two nights of increasingly terrifying earthquakes flattened houses and triggered major landslides in southern Japan. (AP Photo/Shizuo Kambayashi)

4. Natural catastrophes (24 percent; 2016: 24 percent)

(e.g. storm, flood, earthquake)

Natural catastrophes and climate change/increasing volatility of weather rank high on the agenda of businesses this year, particularly in Asia where the costliest disaster globally of 2016 occurred — the Kumamoto earthquake (Japan). Natural catastrophes rank as the top concern in Japan and Hong Kong, as well as globally among engineering/construction and power and utilities companies.

Related: 6 steps to maximize business insurance recoveries before the next weather event

Natural catastrophes accounted for $175 billion in economic losses in 2016, a four-year high, with insured losses totaling some $50 billion, according to Munich Re. At the same time, businesses are also more concerned about the impact of climate change/increasing weather volatility year-on-year, with this risk climbing to 14th position (6 percent of responses).

“Natural catastrophes and climate change worry our customers and society at large,” says Axel Theis, Board Member of Allianz SE. “We must assume that global warming above 1.5 degrees Celsius would intensify climate damages, for example from heat waves and rising sea levels, significantly. It is our task as an insurer to develop solutions for these scenarios and establish prevention and insurance protection for, and together with, our customers and public partners.”

A report by the ClimateWise coalition, which comprises 29 insurers including Allianz, warns of a $100 billion “protection gap” in the global insurance sector as a result of the rising impact of climate risks.

(Photo: iStock)

3. Cyber incidents (30 percent; 2016: 28 percent)

(cyber crime, IT failure, data breaches, etc.)

Cyber risk occupies a significant portion of a company's exposure map. The risk now goes far and beyond the issue of privacy and data breaches. A single incident, be it a technical glitch, human error or an attack, can lead to severe business interruption and loss of market share.

Of the top 10 global risks in the 2017 Allianz Risk Barometer, a cyber incident could be a potential root cause or trigger for 50 percent of the identified risks.

Related: Supply chain cyber risks: What's at stake for your business?

The toughening of data protection regulation regimes around the world is also contributing to this risk being at the forefront of risk managers' minds, as penalties for non-compliance are increasingly severe.

The growing sophistication of cyber-attacks is the impact of increasing digitalization companies fear most (45 percent of responses), while cyber risk is also the top long-term peril (42 percent), results show. However, cyber incidents ranks just sixth for small-sized companies.

Many companies underestimate their exposure and are not prepared for, or are able to respond to an incident, with a lack of resources to do so a contributing factor.

(Photo: iStock)

2. Market developments (31 percent; 2016: 34 percent)

(volatility, intensified competition/new entrants, M&A, market stagnation, market fluctuation)

Market developments and volatility is the second most important business peril in 2017, and the top concern in the aviation/defense, financial services, marine and shipping and transportation sectors, as well as across the Africa & Middle East region in general.

In order to anticipate any sudden changes of rules that could impact markets, companies will need to invest more resources into better monitoring politics and policy-making around the world in 2017.

Companies are concerned about the potential risk impact of factors such as intensified competition, mergers and acquisitions (M&A) and market stagnation. At the same time increasing dependence on technology and automation is transforming and disrupting companies across industry sectors, including the insurance industry.

(Photo: iStock)

1. Business interruption (37 percent; 2016: 38 percent)

(includes supply chain disruption and vulnerability)

What troubles businesses most are actual or anticipated losses from a business interruption. Many of the top 10 risks in this year's barometer can have severe business interruption implications.

Related: Understanding business interruption and property insurance values

In today's interconnected industrial world, the reasons for business interruption are expanding from damage-driven events, such as natural catastrophe or fire incidents, to non-physical damage or intangible perils, such as cyber incidents as well as disruption caused by political violence, strikes and terror attacks.

Supply chain disruption can result from overreliance on a sole or key supplier. Constantly updated business continuity plans that involve all facets of an organization are effective in understanding supply chain exposures and critical internal and external suppliers.

See also: Full list of top 10 business risks for each region and for 25 different countries

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.