When protests, riots or civil disorders break out, business, home and vehicle owners can suffer, and property damage can result in large losses for insurers. Sometimes even a harmless gathering can suddenly turn into an ugly mob, causing looting, vandalism and fires that can cause millions of dollars in damage.

Depending on the type of property involved, there are several types of insurance coverages available to protect policyholders from most forms of civil commotion.

Recent costly uprisings

In 2015, arson and looting occurred in Baltimore, Md., following the funeral for Freddie Gray, a 25-year-old who died after suffering a spinal cord injury while in police custody. The estimated insured loss from the property damage is about $24 million, according to the Insurance Information Institute (I.I.I.).

Recommended For You

After a grand jury failed to indict Ferguson, Mo., police officer Darren Wilson for shooting Michael Brown in the summer of 2014, riots erupted throughout Ferguson and prompted protests across the country. More than two dozen businesses ranging from restaurants and drug stores to gas stations and large chains were damaged by fires and looters. It's not clear how much the violence cost in terms of total insured losses in the low-income area of Ferugson.

Peaceful protests have recently been in the news throughout the United States. Thankfully, no violence or widespread property damage has been reported. However, if you lived through the 1960s, you may not be surprised to learn that five of the costliest civil disorders in the U.S. occurred in that era. The first Fair Access to Insurance (FAIR) Plans, designed to provide property insurance in high-risk areas, were developed in response to these uprisings.

FAIR Plans

Historically, many riots take place in marginalized, economically depressed neighborhoods. In 1967, riots broke out in many cities across the nation. As property insurers withdrew from inner-city neighborhoods, citing huge losses, insurance departments and insurance industry leaders were called upon to expand existing urban plans and create new ones which eventually led to the establishment of FAIR Plans, the I.I.I. explains.

The concept of FAIR Plans was established following passage by Congress of the Housing and Urban Development Act of 1968, a measure designed to address the conditions that led to the 1967 urban riots. This legislation made federal riot reinsurance available to those states that instituted such property insurance pools.

Based on data from the Property Claim Services, a Verisk Analytics business, and the I.I.I., here are the top 10 most costly U.S. civil disorders, as of April 30, 2015:

(Photo: iStock)

10. Cleveland, Ohio - Glenville Shootout

July 23-24, 1968

On the evening of July 23, 1968, violence erupted between police and a black militant group led by Fred (Ahmed) Evans within Cleveland's 6-square-mile Glenville neighborhood. When order was finally restored on July 28 by the National Guard, 7 people were dead and 15 wounded. (Source: The Glenville Shootout, The Cleveland Memory Project)

Estimated insured loss at the time: $1.5 million

Estimated insured loss in 2014 dollars: $10.2 million

One of the signs along historic Route 66 in downtown Albuquerque, N.M. (AP Photo/Susan Montoya Bryan)

9. Albuquerque, N.M. – Roosevelt Park

June 13-15, 1971

On June 13, 1971, rioting broke out at Roosevelt Park after police attempted to arrest a young man standing in a crowd of several hundred rowdy youth. A small scuffle escalated into a brawl, leading officers to fire upon the crowd, wounding at least nine people.

Outraged, nearly 500 youths moved into the downtown area, where they overturned cars, shattered windows, looted, and severely damaged and destroyed buildings. Police attacked rock- and bottle-throwing protesters with tear gas but were overwhelmed. New Mexico National Guardsme came into the city to assist officers. (Source: Latino Rebels)

See also: National Guard mobilized to curb Albuquerque riots, The Prescott Courier, June 14, 1971.

Estimated insured loss at the time: $3 million

Estimated insured loss in 2014 dollars: 17.5 million

Policemen grab a youth who refused to leave scene near fire on Chicago's West side on July 15, 1966. Police pushed back crowds after some onlookers threw rocks at firemen fighting a fire at a one-story bottling company building. (AP Photo/Larry Stoddard)

8. Chicago, Ill. – West Side Fire Hydrant Riot

July 12-15, 1966

Youths clashed with police over an unplugged fire hydrant on the West Side. James Parker, 17, and his friends refused officers' orders to cap the hydrant because kids were splashing in the water. When police arrested Parker and his friends, neighbors rioted. (Source: Chicago Reporter)

Stores were looted and burned throughout Chicago's West Side until 1,200 National Guardsmen arrived on July 15. Violence quickly subsided and most of the troops were sent home on July 20. (Source: Wikipedia)

Estimated insured loss at the time: $4 million

Estimated insured loss in 2014 dollars: $29.3 million

Newark firemen stand amid debris and litter while trying to save burning structures early July 14, 1967 in Newark. N.J. Rioting that erupted in the predominantly black area of Newark's central ward spread to a mile-long area of destruction that reached the heart of the business district. This scene is at corner of Spruce and Charlton streets in Newark. (AP Photo)

7. Newark, N.J. – Newark Riot

July 12-21, 1967

Newark, N.J., dissolved into a bloody riot that would, over the next six days, leave 26 individuals dead, hundreds injured and between $10 million and $15 million in property damage.

Violence erupted after a cab driver who was arrested for allegedly driving around a double-parked police car was severely beaten by police officers. When rumor spread that the cab driver had died in police custody, an angry crowd threw bricks and bottles at the precinct.

Three nights into the riot, New Jersey Governor Richard Hughes declared a state of emergency. The violence began to subside on July 17, when National Guardsmen and state troopers moved out of Newark.

In the end, 24 African-Americans, one white police detective and one white fireman were killed — most of them by police or National Guard troops aiming at suspected snipers. More than 1,500 individuals were arrested. (Source: Long Civil Right Movement)

Estimated insured loss at the time: $11 million

Estimated insured loss in 2014 dollars: $78 million

Police and demonstrators gather in the aftermath of rioting following Monday's funeral for Freddie Gray, who died in police custody, on Tuesday, April 28, 2015, in Baltimore. (AP Photo/Evan Vucci)

6. Baltimore, Md. – Freddie Gray Funeral

April 25-27, 2015

Between April 25 and 27, 2015, looting and arson occurred in Baltimore, Md., following the funeral for Freddie Gray, a 25-year-old who died after suffering a severe spinal cord injury while in police custody.

Estimated insured loss in dollars at the time: $23.9 million

Firefighters in the Bronx battle flames in one of the many fires raging in stores throughout New York City during the blackout of 1977 in this July 14, 1977 file photo. The blackout, which lasted 25 hours, was marked by looting and chaos. (AP Photo, File)

5. New York City, N.Y. – NYC Blackout

July 13-14, 1977

In a blackout that lasted from 9:34 p.m. on July 13 to 10:39 p.m. on July 14, 1,000 fires were reported, 1,600 stores were damaged amid looting and rioting and 3,700 people were arrested. Neighborhoods from East Harlem to Bushwick were devastated. (Source: The New York Times)

A series of lightning strikes on power lines and infrastructure led to a cascade of shutdowns, overloads and failures. An hour after the first strike, the entire Con Edison system powering New York City shut down completely.

The crisis came during a heat wave, a financial downturn, rising poverty and inequality, and an atmosphere of paranoia brought on by the Son of Sam murders. No sooner had the lights gone out than the looting and arson began. (Source: Mashable)

Estimated insured loss at the time: $28 million (Includes losses caused primarily by fires, looting, vandalism and malicious mischief)

Estimated insured loss in 2014 dollars: $109.4 million

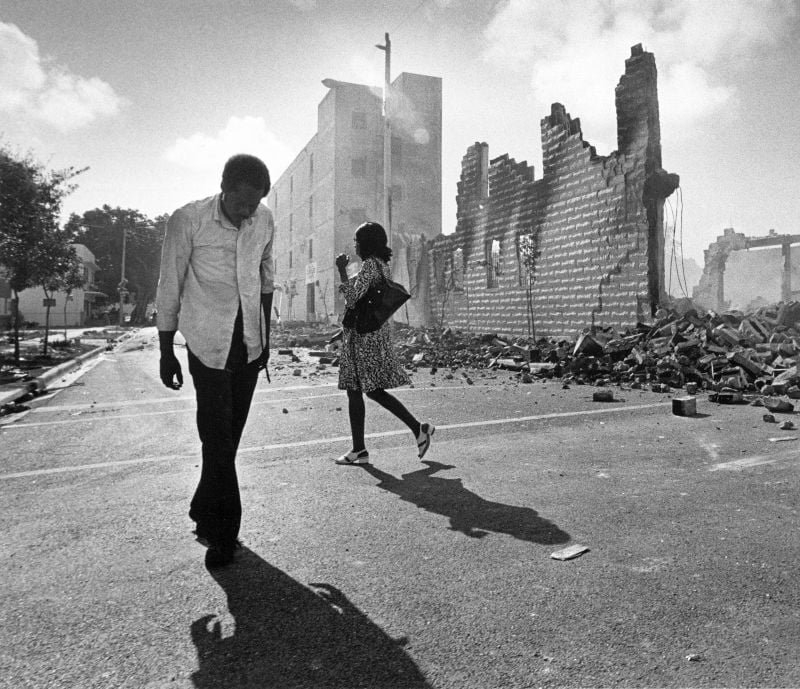

People walk past ruins in the Culmer section of Miami May 19, 1980 after rioting over the acquittal of four police officers charged with the 1979 beating death of Arthur McDuffie, a black motorcyclist. (AP Photo/Kathy Willens)

4. Miami, Fla. – McDuffie Riots

May 17-19, 1980

A three-day race riot exploded in Miami when a group of Miami-Dade Police officers were acquitted after being charged with beating a black man to death over a traffic violation.

Arthur McDuffie reportedly led cops on a high-speed chase on his motorcycle in December 1979.When he stopped, put his hands in the air and said "I give up," police allegedly beat him so hard with their nightsticks they cracked his skull in half. McDuffie died after days in a coma.

After an all-white jury deliberated for just three hours at the trial in Tampa, all the officers involved were acquitted of any crime.

Outrage sparked back in Miami where a May 18th protest downtown escalated to a burning, three-mile-wide riot in Liberty City. (Source: The Huffington Post)

Estimated insured loss at the time: $65.3 million

Estimated insured loss in 2014 dollars: $187.5 million

In this Aug. 14, 1965 file photo, firefighters battle a blaze set in a shoe store that collapses in flames during rioting in the Watts district of Los Angeles. (AP Photo, File)

3. Los Angeles, Calif. – Watts Riot

August 11-15, 1965

In the predominantly black Watts neighborhood of Los Angeles, racial tension reached a breaking point after two white policemen scuffled with a black motorist suspected of drunken driving.

A crowd of spectators gathered near the corner of Avalon Boulevard and 116th Street to watch the arrest and soon were angered by what they believed to be yet another incident of racially motivated abuse by the police. A riot soon began, spurred on by residents of Watts who were embittered after years of economic and political isolation.

The rioters eventually roamed over a 50-square-mile area of South Central Los Angeles, looting stores, torching buildings and beating whites as snipers fired at police and firefighters. Finally, with the assistance of thousands of National Guardsmen, order was restored on August 16.

The five days of violence left 34 dead, 1,032 injured, nearly 4,000 arrested, and nearly $40 million worth of property destroyed. (Source: history.com)

Estimated insured loss at the time: $38 million

Estimated insured loss in 2014 dollars: $285.6 million

City of Detroit crew busy at work cleaning up debris on 12th street in Detroit, July 27, 1967, where the most damage was caused during the riots. A ruptured gas line burns through a pile of rubble at left. (AP Photo)

2. Detroit, Mich. – 12th Street Riot

July 23-31, 1967

In the early morning hours of July 23, 1967, one of the worst riots in U.S. history broke out on 12th Street in the heart of Detroit's predominantly African-American inner city. By the time it was quelled four days later by 7,000 National Guard and U.S. Army troops, 43 people were dead, 342 injured, and nearly 1,400 buildings had been burned. (Source: history.com)

Estimated insured loss at the time: $41.5 million

Estimated insured loss in 2014 dollars: $294.2 million

This April 29, 1992 file photo shows several buildings in a Boys Market shopping center fully engulfed in flames before firefighters can arrive as rioting erupted in South Central Los Angeles. The acquittal of four police officers in the videotaped beating of Rodney King sparked rioting that spread across the city and into neighboring suburbs. Cars were demolished and homes and businesses were burned. Before order was restored, 55 people were dead, 2,300 injured and more than 1,500 buildings were damaged or destroyed. (AP Photo/Reed Saxon, File)

1. Los Angeles, Calif. – Rodney King Verdict

April 29 – May 4, 1992

Four Los Angeles police officers that had been caught beating Rodney King, an unarmed African-American motorist, in an amateur video were acquitted of any wrongdoing in the arrest. Hours after the verdicts were announced, outrage and protest turned to violence. Rioters in South Central Los Angeles blocked freeway traffic and beat motorists, wrecked and looted numerous downtown stores and buildings, and set more than 100 fires. (Source: history.com)

Estimated insured loss at the time: $775 million

Estimated insured loss in 2014 dollars: $1,308 million

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.